Passive Cooling Materials and Devices: New Markets 2023-2043

PDF Download Report

Single User License - Allowing one user access to the product.

Site License - Allowing all users within a given geographical location of your organisation access to the product.

Enterprise License - Allowing all employess within your organisation access to the product.

PDF Download Report

Single User License - Allowing one user access to the product.

Site License - Allowing all users within a given geographical location of your organisation access to the product.

Enterprise License - Allowing all employess within your organisation access to the product.

PDF Download Report

Single User License - Allowing one user access to the product.

Site License - Allowing all users within a given geographical location of your organisation access to the product.

Enterprise License - Allowing all employess within your organisation access to the product.

Sample Pages

Contents List

-

Analysis

1.1 Purpose of this report

1.2 Methodology of this analysis

1.3 The big picture 1.3.1 Primary conclusions: passive cooling main market drivers and by sector in 2043

1.3.2 How cooling will be required for very large to very small locations

1.3.3 Electrification will be more important than the hydrogen economy

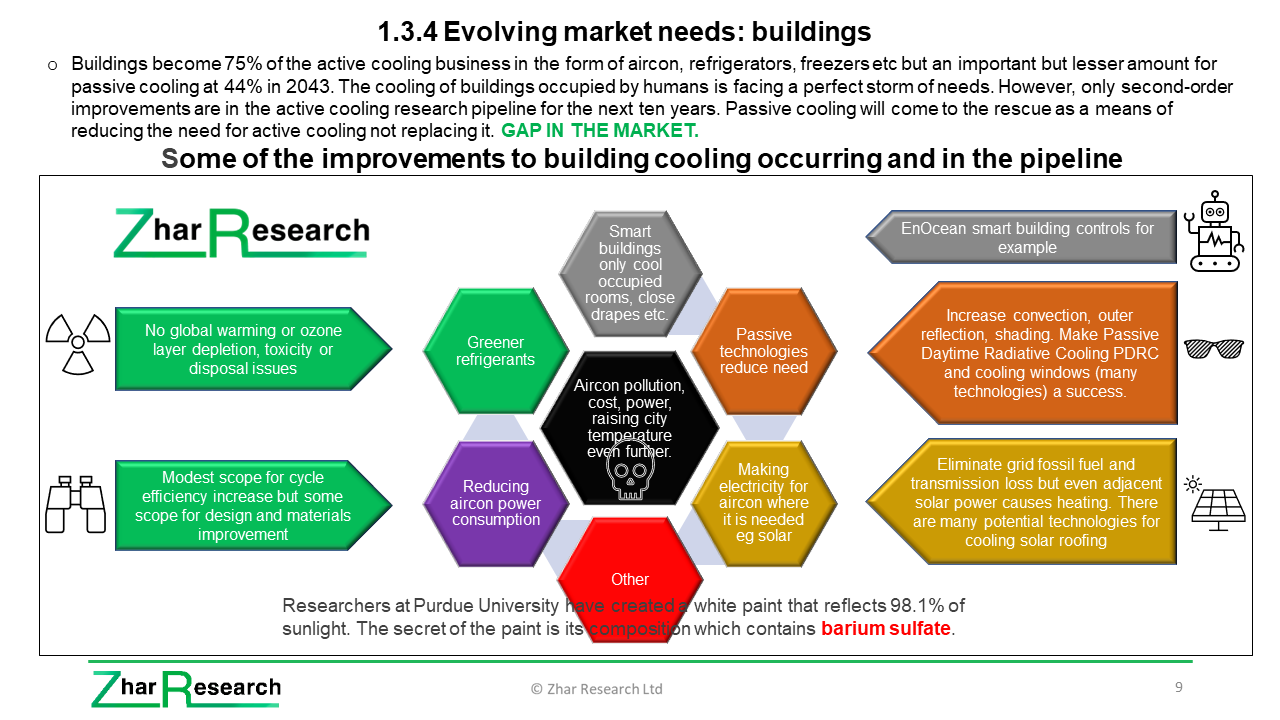

1.3.4 Evolving market needs: buildings

1.3.5 Some needs get crimped and fuel supply chains and vehicles get simpler

1.4 Technology for passive cooling 2023-2043

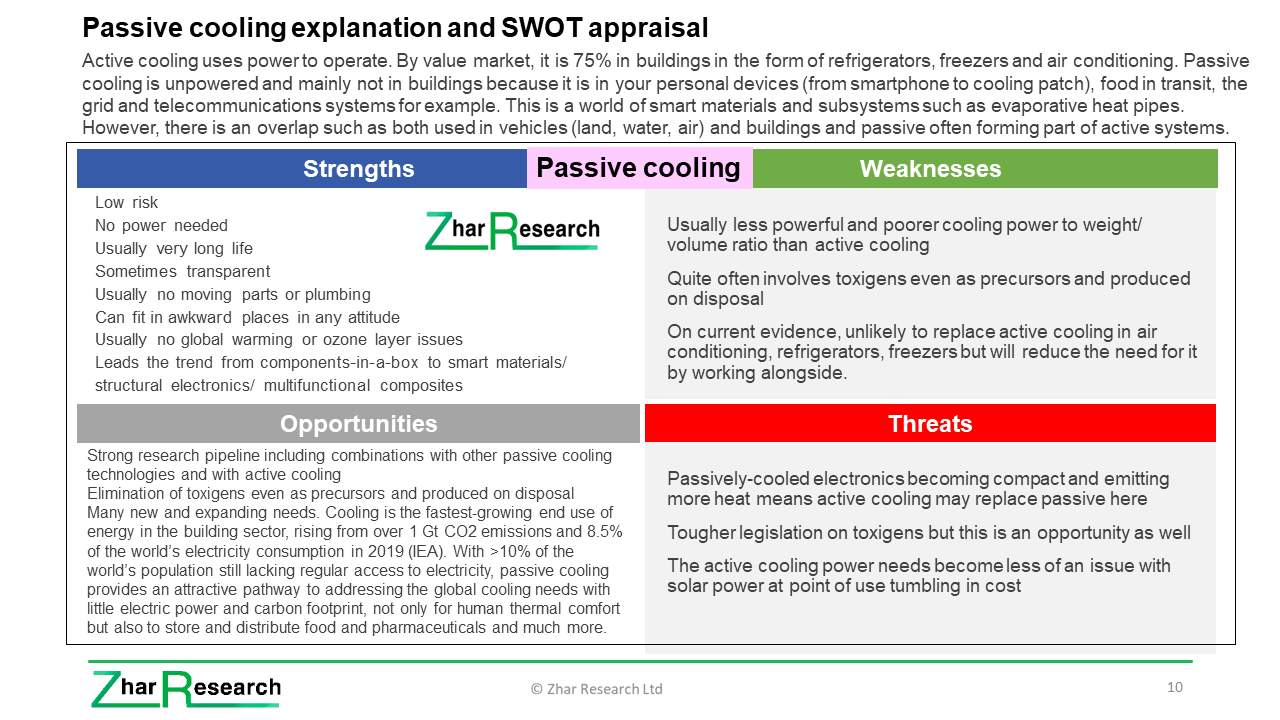

1.4.1 Overview and SWOT appraisal

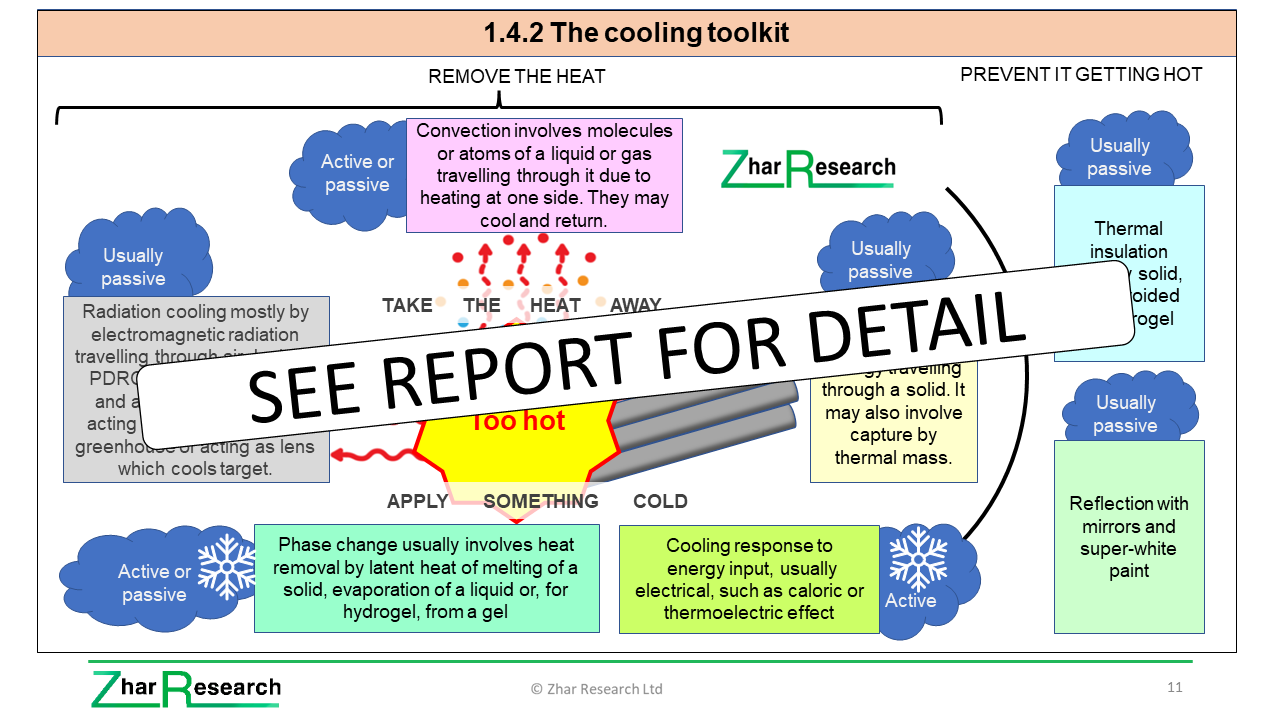

1.4.2 The cooling toolkit

1.4.3 Examples of principles employed for cooling or prevention of heating

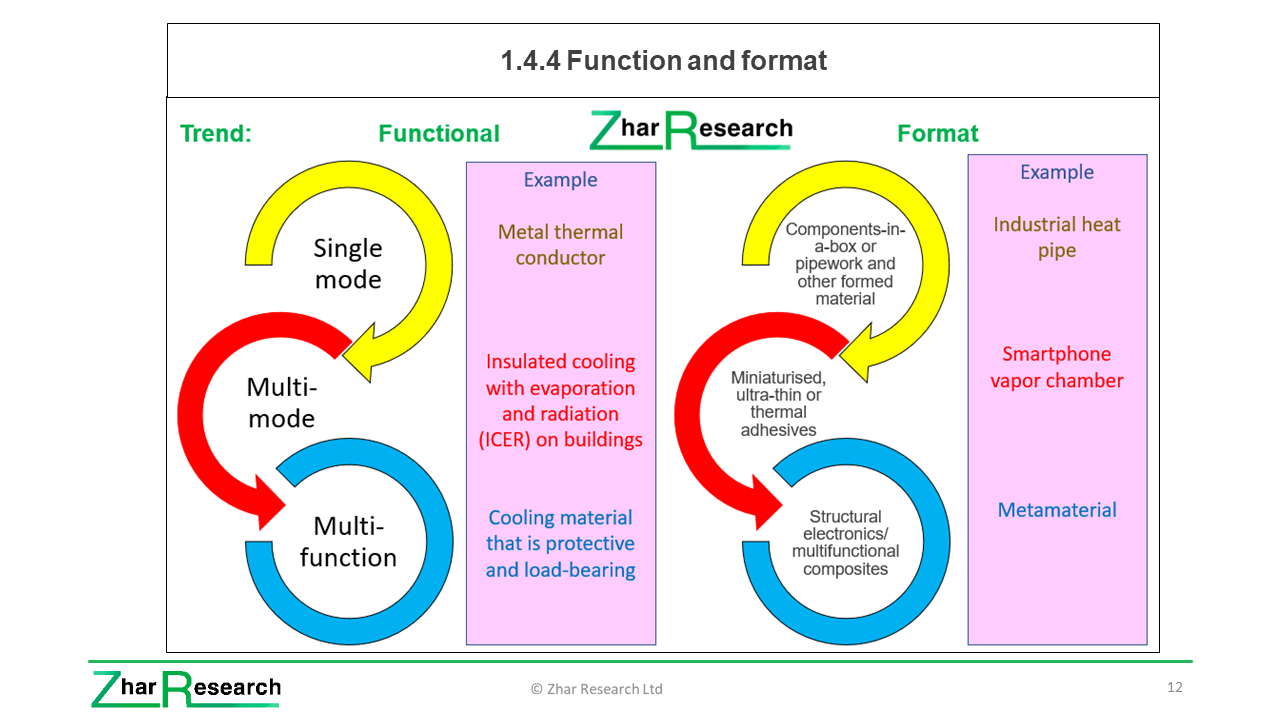

1.4.4 Function and format

1.4.5 SWOT appraisal of Passive Daytime Radiative Cooling PDRC

1.4.6 Primary conclusions: technologies

1.5 Opportunities for passive cooling materials 2023-2043 1.5.1 Overview

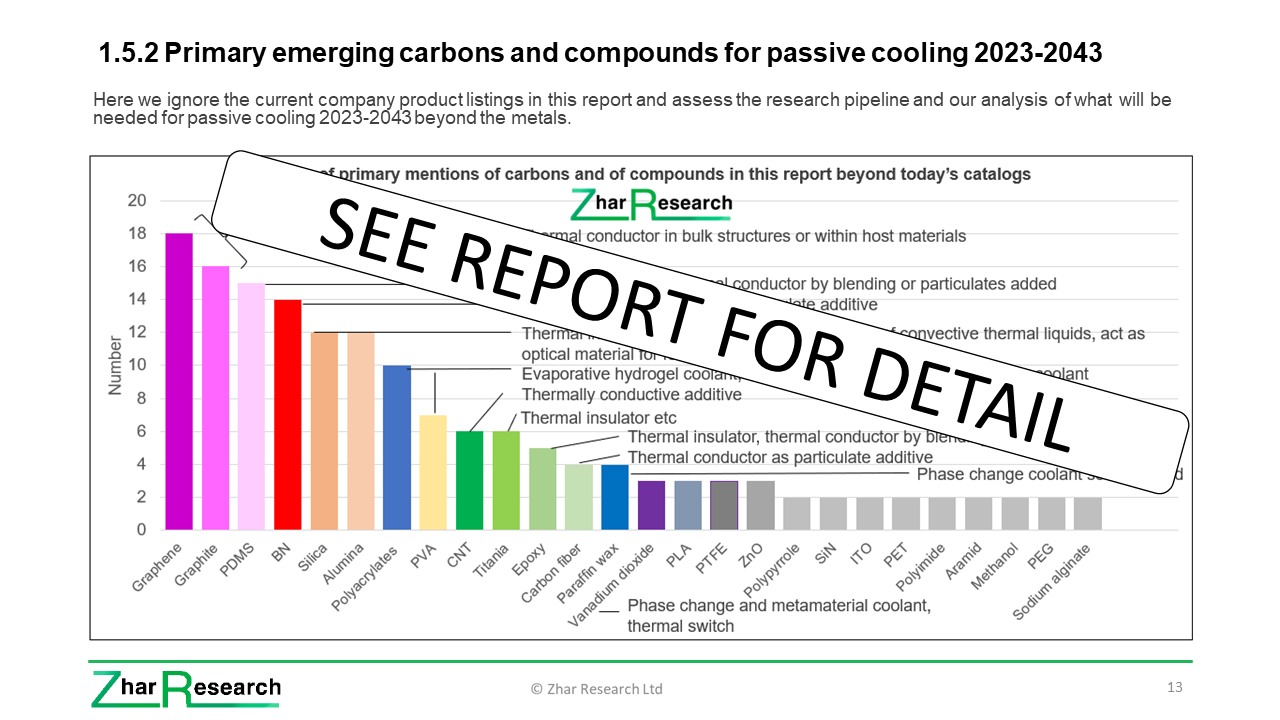

1.5.2 Primary emerging carbons and compounds for passive cooling 2023-2043

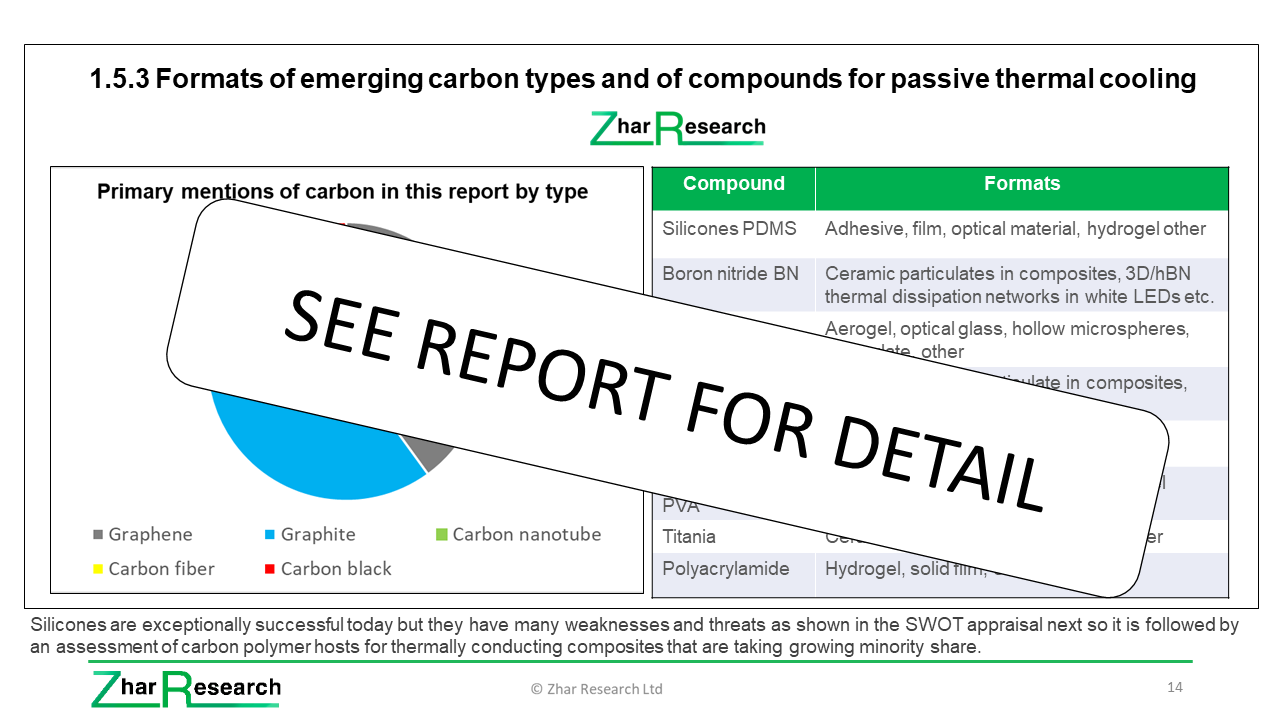

1.5.3 Formats of emerging carbon types and of compounds for passive thermal cooling

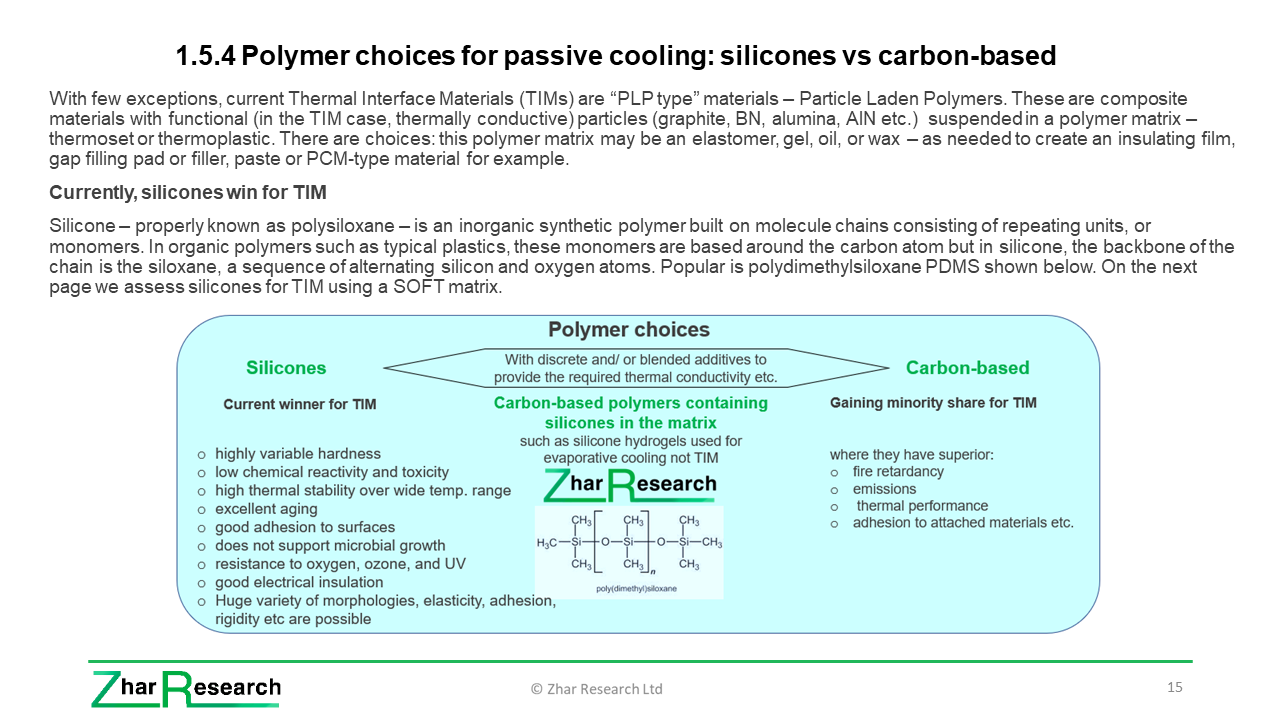

1.5.4 Polymer choices for passive cooling: silicones vs carbon-based

1.5.5 SWOT appraisal for silicone thermal conduction materials

1.5.6 Carbon-based polymers: host materials and particulates prioritised in research

1.5.7 The future of thermal interface materials

1.5.8 SWOT appraisal of self-cooling radiative metafabric

1.5.9 SWOT appraisal of anti-Stokes radiative fluorescence cooling

1.5.10 Phase change cooling modes and materials

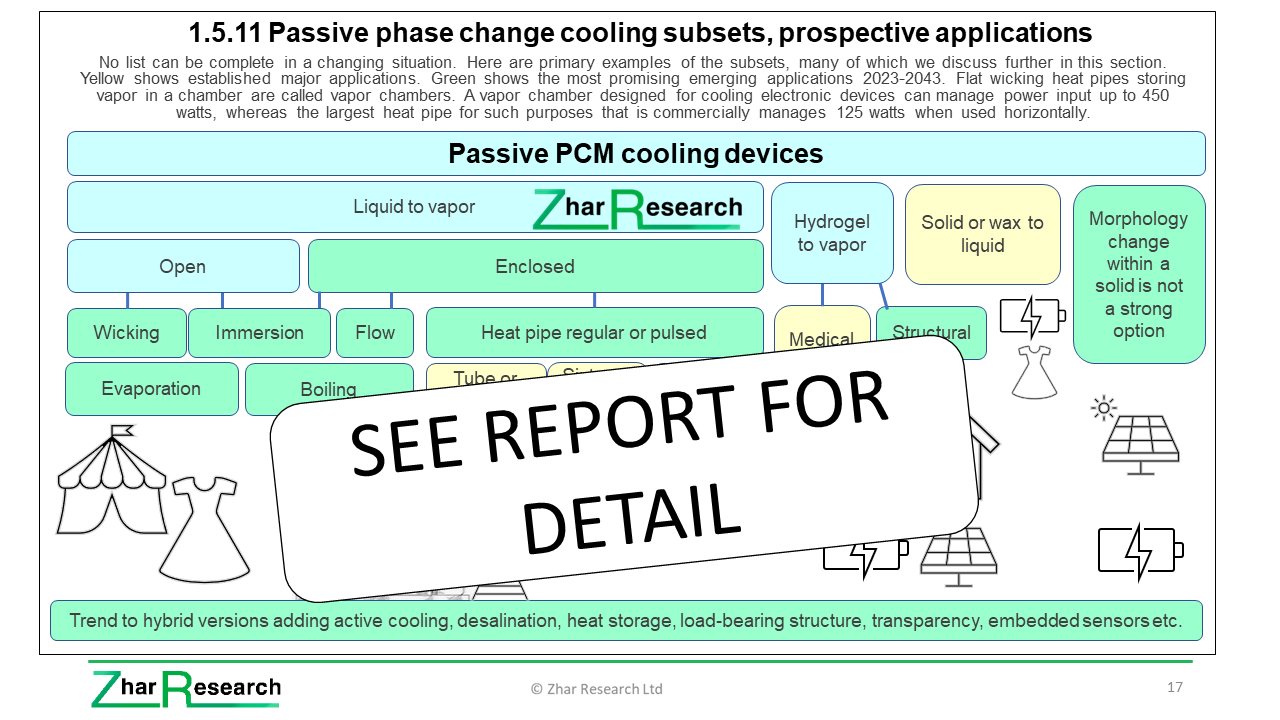

1.5.11 Passive phase change cooling subsets, prospective applications

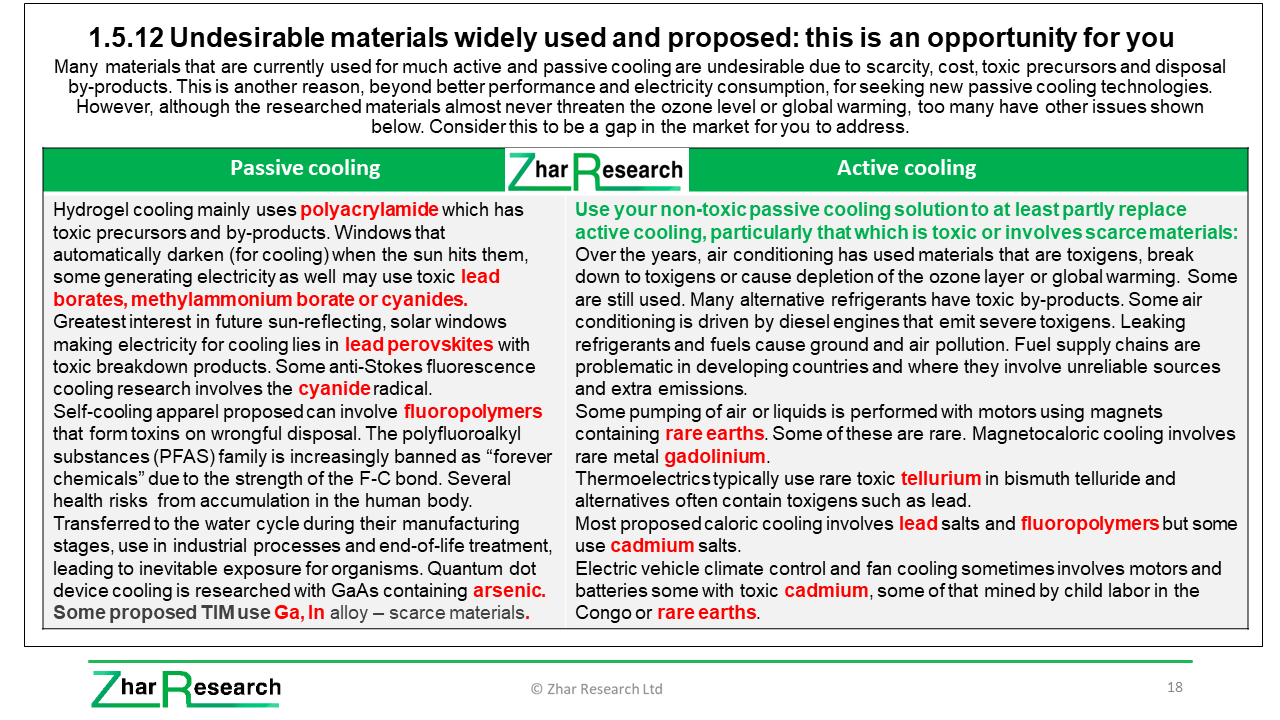

1.5.12 Undesirable materials widely used and proposed: this is an opportunity for you

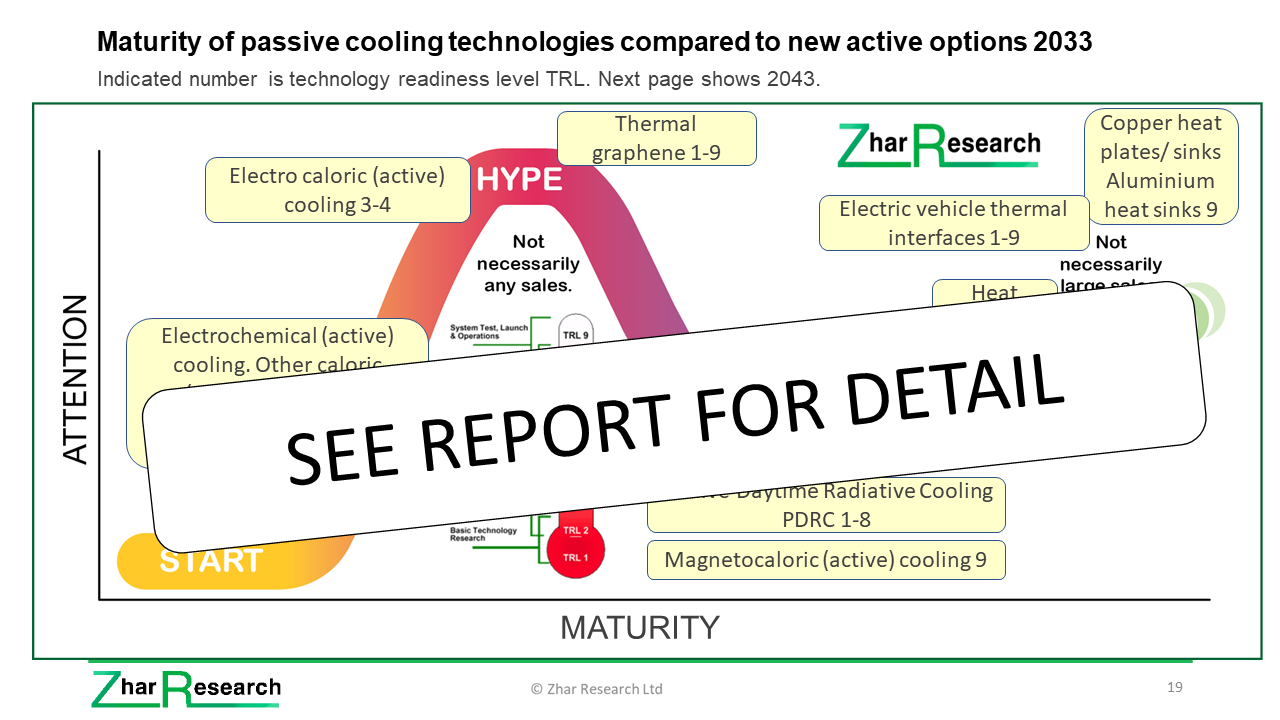

1.6 Maturity of passive cooling technologies vs new active options 2023, 2033, 2043

MARKET FORECASTS AND ROADMAPS

1.7 Market forecasts 2023-2043 in 28 lines

1.7.1 Passive vs active cooling market $ billion 2023-2043

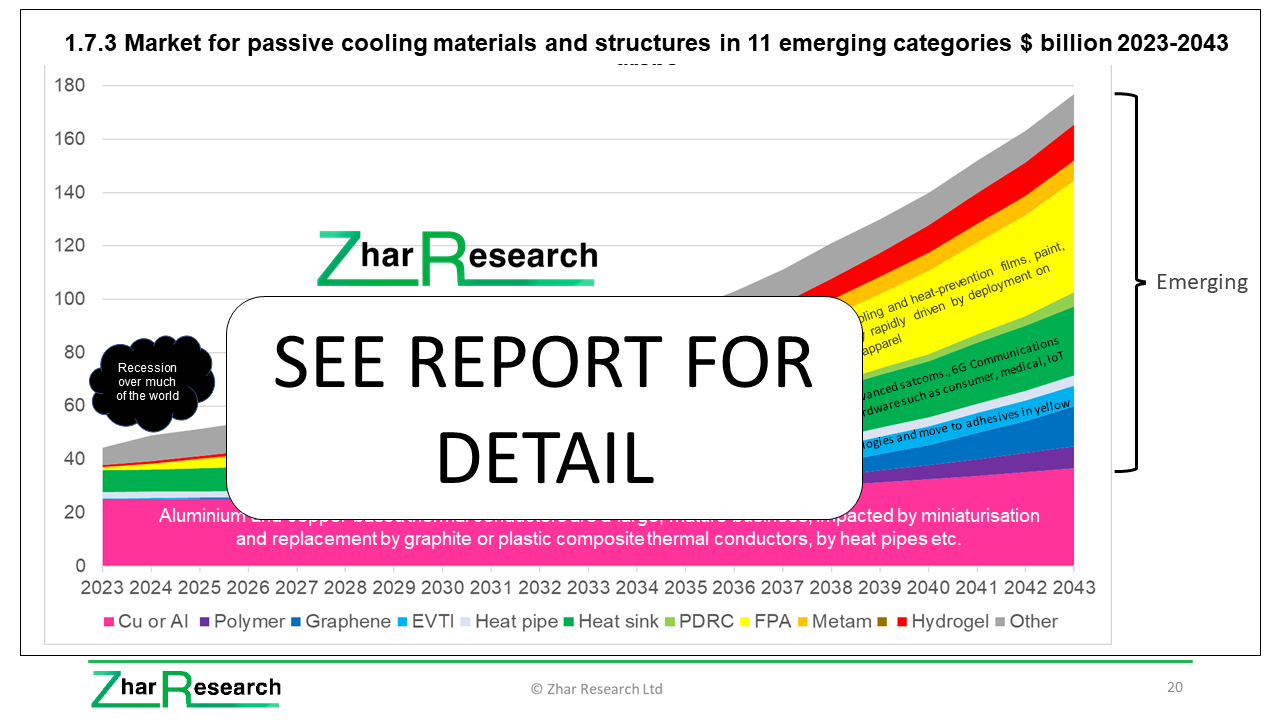

1.7.2 Market for passive cooling materials and structures in 11 categories highlighting emerging technologies $ billion 2023-2043 table

1.7.3 As above as area graph with commentary

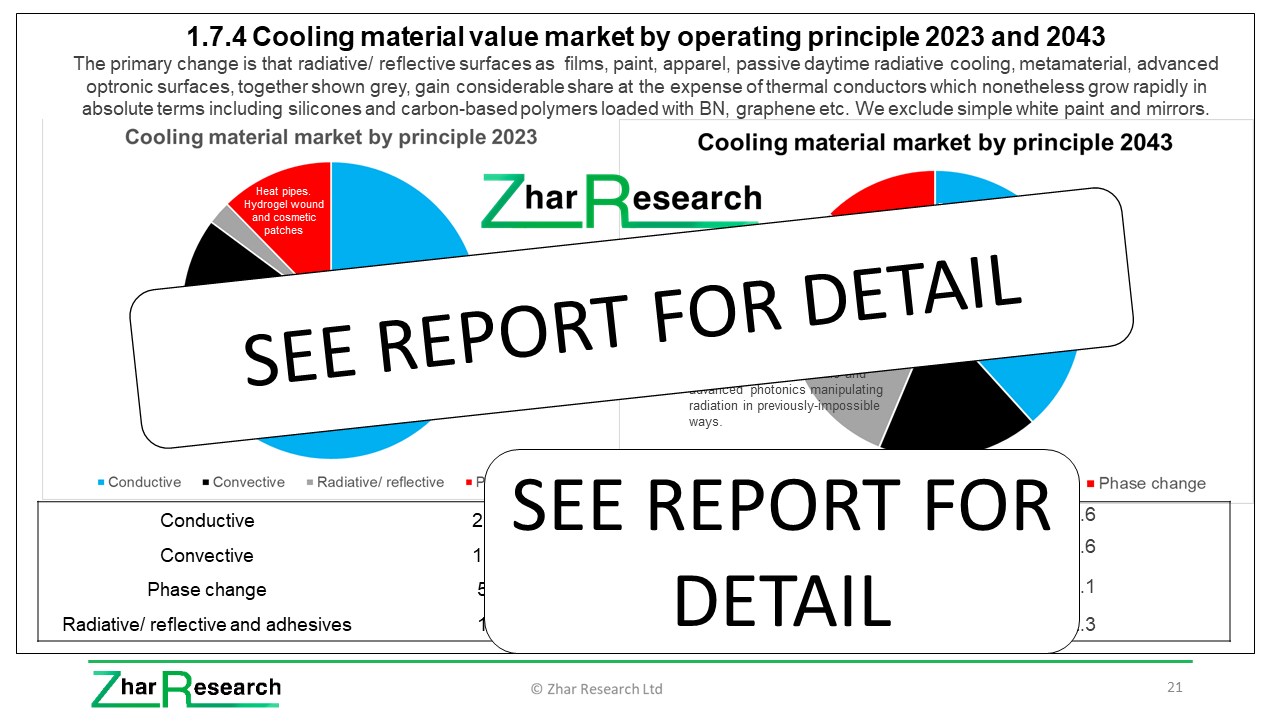

1.7.4 Cooling material value market by operating principle 2023 and 2043

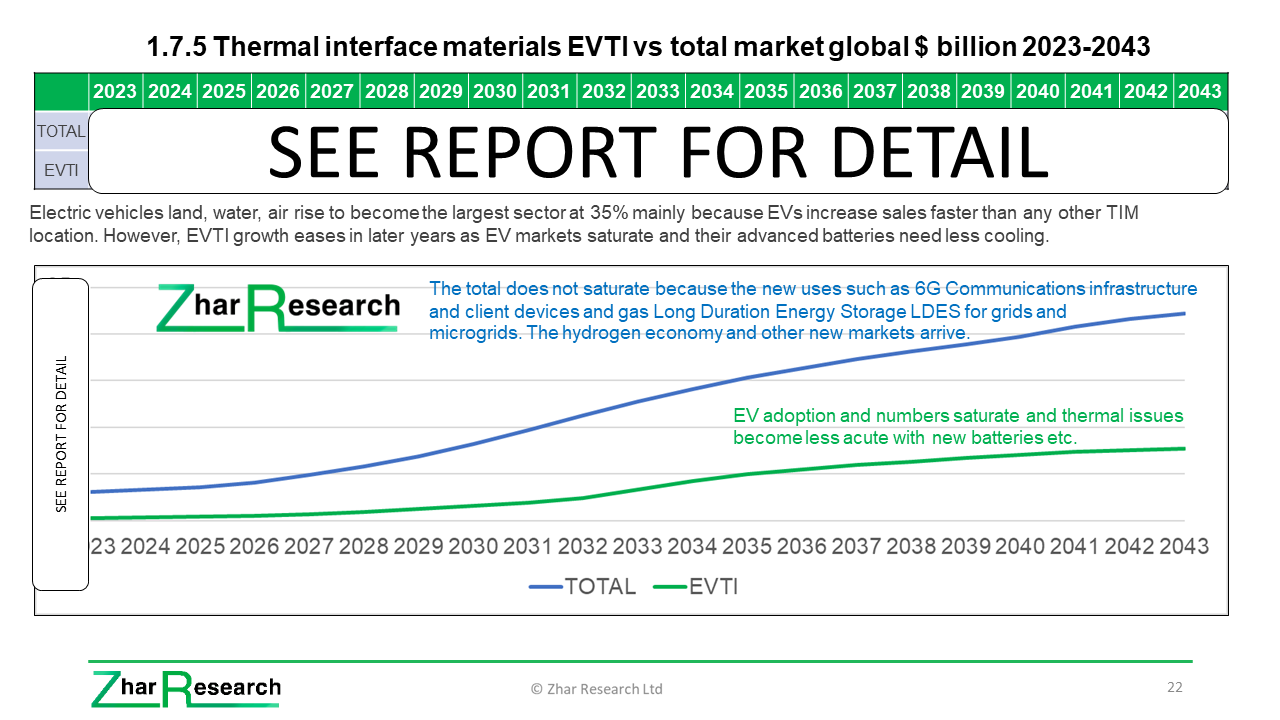

1.7.5 Thermal interface materials EVTI vs total market global $ billion 2023-2043

1.7.6 Heat pipe global market $ billion 2023-2043

1.7.7 Heat sink market global $ billion 2023-2043

1.7.8 Thermal conduction market for copper vs polymer vs graphene structures global $ billion 2023-2043

1.7.9 Market for all hydrogels vs hydrogel cooling $ billion 2023-2043

1.7.10 Market for all metamaterials vs metamaterial cooling $ billion 2023-2043

1.7.11 Thermally conductive additives market global $ billion 2023

1.7.12 Paint and external surfaces specifically designed for passive cooling global $ billion 2023-2043

1.7.13 Convective, metamaterial and other cooling materials and structures

1.7.14 6G base stations thermal interface materials M square meters 2023-2043

1.7.15 Smartphone thermal materials area million square meters 2023-2043

1.7.16 Internet of Things nodes possible 6G impact number billion 2023-2043

1.7.17 Thermal material location hardware market $ billion 2023

1.7.18 Thermal conductive, insulating and low-loss materials share for 6G Communications in 2036

1.7.19 6G hardware value market by type 2036

1.7.20 6G and 6G/5G smartphone combined sales units billion yearly 2023-2043

1.7.21 Smartphones billion yearly with 6G impact 2023-2043

1.8 Passive cooling roadmap by market and by technology 2022-2031

1.9 Passive cooling roadmap by market and by technology 2032-2043

-

2.1 Cooling needs increase for many reasons 2023-2043

2.2 Cooling people and things: the active and passive cooling toolkit

2.2.1 Cooling people is different from cooling things

2.2.2 Active and passive cooling compared

2.3 Some emerging opportunities set the scene

2.3.1 Cooling apparel: the unsolved problem

2.3.2 Food supply chains and medical: new opportunities

2.3.3 Greater challenges and opportunities cooling semiconductors

2.3.4 Cooling various forms of solar power: large emerging need, new possibilities

2.4 Examples of both active and passive cooling needed in a given system 2.4.1 Four sectors compared: multiple solutions

2.4.2 Major new cooling opportunities in electronics and ICT

2.4.3 6G Communications in 2030 grows cooling demand: analysis and SWOT 2.4.4 Activity of 17 companies against 3 thermal material criteria

2.4.5 Data center thermal challenges increase

2.5 Growing problems create large passive cooling opportunities in buildings

2.5.1 Overview

2.5.2 Example: NEOM smart city Saudi Arabia

2.6 New passive cooling must assist active cooling of buildings, refrigerators, freezers, vehicles

2.7 Electric vehicles land, water and air create major new needs for thermal management

2.8 New large batteries need better thermal management or lower cost: annotated Ragone plot by technologies and Henkel examples

2.9 Cooling power-hungry power electronics for grids, microgrids, telecoms.

2.10 Thermal insulation for heat spreaders and other passive cooling

2.10.1 Silica aerogel is trending: example W.L.Gore enhancing graphite heat spreader performance

2.10.2 Protecting smartphones from heat

2.10.3 15 companies involved in silica aerogel colling and heat protection

-

EMERGING TECHNOLOGIES

3.1 Radiative cooling and heat sink convection or radiative cooling

3.1.1 Heat sinks/ radiators can cool convectively or radiatively

3.1.2 Conventional convective heat sinks

3.1.3 Advanced heat sinks: 3DP, graphene, smart fractal microchannel heat sink (SFMHS) integrated with thermo-responsive hydrogels

3.1.4 Passive liquid cooling: two stage and immersion cooling

3.1.5 Increasing the heat carrying capacity of liquid solar panel cooling

3.2 Radiative cooling

3.2.1 Traditional radiative cooling

3.2.2 Future radiative cooling of buildings

3.3 Passive daytime radiative cooling (PDRC)

3.3.1 Overview

3.3.2 New materials innovations

3.3.2 Achieving commercialisation requirements

3.3.3 Example: Nano photonic radiative cooling film for refineries

3.3.4 Color without compromise?

3.3.5 Environmental and inexpensive materials development

3.3.6 SWOT appraisal of Passive Daytime Radiative Cooling PDRC

3.4 Other emerging forms of radiative cooling

3.4.1 Toolkit and maturity curve

3.4.2 Tailorable emittance coatings, paints, tapes

3.4.3 Thermal louvers

3.4.4 Deployable radiators in space

3.4.5 Tuned radiative cooling using both sides: Janus emitter JET

3.4.6 JET for cooling enclosed space

3.4.7 Self-adaptive radiative cooling based on phase change materials

3.4.8 Anti Stokes fluorescence cooling with SWOT appraisal

3.4.9 Self-cooling radiative metafabric

3.4.10 Wearable thermoregulatory fluidic systems

3.5 SWOT appraisal of passive radiative cooling

-

4.1 Overview: adhesives to thermally conductive concrete

4.1.1 TIM, heat spreaders from micro to heavy industrial

4.1.2 Thermal conduction cooling geometries for electronics and electric vehicles

4.1.3 Trending: annealed pyrolytic graphite APG for semiconductor cooling: Boyd

4.1.4 Thermally conductive graphite polyamide concrete

4.2 Important considerations when solving thermal challenges with conductive materials

4.2.1 Bonding or non-bonding

4.2.2 Varying heat

4.2.3 Electrically conductive or not

4.2.4 Placement

4.2.5 Environmental attack

4.2.6 Choosing a thermal structure

4.2.7 Research on embedded cooling

4.3 Thermal Interface Material TIM

4.3.1 General

4.3.2 Seven current options compared against nine parameters 4.3.3 Thermal pastes compared

4.3.4 TIM and other examples today: Henkel, Momentive, ShinEtsu, Sekisui, Fujitsu, Suzhou Dasen

4.3.5 37 examples of TIM manufacturers

4.3.6 Thermal interface material trends as needs change: graphene, liquid metals etc.

4.3.7 Lessons from recent patents

4.4 Polymer choices: silicones or carbon-based

4.4.1 Comparison

4.4.2 Silicone parameters, ShinEtsu, patents

4.4.3 SWOT appraisal for silicone thermal conduction materials

4.5 Thermally conductive carbon-based polymers: targetted features and applications 4.5.1 Overview

4.5.2 Examples of companies making thermally conductive additives

4.5.3 Carbon-based polymers: host materials and particulates prioritised in research

4.6 Quantum dot cooling: 3D BN network in white LEDs

-

5.1 Overview 5.1.1 Phase change cooling modes and materials – three detailed infograms

5.1.2 Peripheral topics: phase change materials in cooling systems for other reasons

5.2 Evaporative cooling in general

5.2.1 Ambitions, limitations

5.2.2 Porous and wick-based evaporative cooling

5.2.2 Sorption-based evaporative cooling

5.3 Closed evaporative cooling: heat pipes

5.3.1 Definition and overview

5.3.2 Principle of operation and uses

5.3.3 Design options and performance

5.3.4 Options for shape and construction: loop heat pipe, vapor chamber, other

5.3.5 Fujitsu loop heat pipe

5.3.6 Samsung Galaxy vapor chambers

5.3.7 Flat plate heat pipes and derivatives

5.3.8 Flat plate heat pipes and derivatives

5.3.9 Emerging new heat pipe designs, materials, targetted uses: bi-porous wick, graphene

5.3.10 Thermal storage heat pipe - graphene nanoplatelets enhanced organic phase change material

5.3.11 Microscale heat pipes for chip cooling: Infinix and research trends

5.3.12 Direct-to-chip: Infinix

5.4 Open evaporative cooling: hydrogels and open wicking

5.4.1 Hydrogel basics and SWOT appraisal

5.4.2 Formulations

5.4.3 Capture

5.4.4 Emerging cooling hydrogels for food, apparel, next microchips, power electronics, data centers, solar panels, large batteries, cell towers and buildings

5.4.5 Moisture thermal battery for future CPU, antennas, power transistors, 6G base stations etc

5.4.6 Aerogel and hydrogel together cool pharmaceuticals and food

5.4.7 Hydroceramic hydrogel cooling architectural structure

5.4.8 Self-cooling smart actuator for soft robotics

5.4.9 Cooling solar panels and gathering water

5.4.10 Cooling with heat harvesting and electricity generation

5.5 Wicking reinvented for tents

5.6 Phase change cooling by melting solids and waxes for battery, solar panel and apparel cooling 5.6.1 Overview

5.6.2 Passive cooled PV panels by phase change materials that melt

5.6.3 Phase change cooling of apparel by melting

5.7 Phase change material enhanced radiative cooling

-

6.1 Metamaterials 6.1.1 Metamaterial and metasurface basics

6.1.2 The meta atom, patterning and functional options

6.1.3 SWOT assessment for metamaterials and metasurfaces generally

6.2 Metasurface energy harvesting and cooling 6.2.1 Metamaterial energy harvesting for metamaterial active cooling

6.2.2 Cooling metamaterials for buildings, solar panels, electronics

6.2.3 Cooling metamaterial developers, manufacturers: Metamaterial Technologies, Plasmonics and, in the past, Radi-Cool

6.3 Advanced photonic cooling and prevention of heating

-

7.1 Overview

7.2 Buildings, windows 7.2.1 Multi-mode ICER passive cooling

7.2.2 Radiative cooling extra strong wood derivative structural material

7.2.3 SkyCool radiative cooling for aircon and refrigeration

7.2.4 Smart windows

7.3 Aircraft: strong aerogel multipurpose thermal insulation

7.4 Cooling paints and fabrics

7.4.1 Overview

7.4.2 Super white paint for multimode cooling

7.5 Electronics 7.5.1 Integration of thermal materials

7.5.2 Smartphone: 3D ice-level dual pump VC liquid cooling Infinix, Nubia 7.5.3 6G Communications

7.6 Evaporative cooling of solar panels with desalination

7.7 Medical: multi-mode passive cooling in electronic skin patches

7.8 Self repairing and cooling

This report is created to assist you to create a billion-dollar materials or device business from the emerging passive cooling market at $177 billion in 2043. It will also be extremely useful to those seeking the best cooling for their future products and systems. Uniquely, the Zhar Research report, “Passive cooling materials and devices: new markets 2023-2043” reveals your total opportunity. That market is leaping almost fourfold for the sophisticated materials and subsystems now required. 58% of that value market will be for electronics and electrical engineering systems including electric vehicles, information, computer and telecommunications ICT structures and devices. Also importantly, 25% of the total market will be for buildings (global warming, improved living standards., emerging nations in tropics) so this breadth of demand de-risks your investment and this report analyses and predicts all of it.

Help cool the hotter data centers, vast areas of solar panel, forthcoming 6G Communications, liquid, and compressed air long duration electricity storage and by electric vehicles by land, water and air. All appraised in this report revealing your opportunities and gaps in the market. The higher added-value materials emerging vary from aerogels, hydrogels, and new polymer blends, annealed pyrolytic graphite, graphene composites, 3D porous boron nitride, hollow silica microspheres and thermal liquids loaded with various metal oxides to increase thermal capacity. Your skills in silicones and polyacrylates are also necessary in increasingly sophisticated forms but that is part of a long list identified.

Learn your opportunities in the next generations such as Passive Daylight Radiative Cooling PDRC and Insulated Cooling with Evaporation and Radiation ICER. After all, the report calculates strong growth in reinvented conductive, convective and phase change passive cooling but even faster growth in radiative cooling including the new metamaterial and advanced optronics approaches as well as that PDRC and ICER.

The executive summary and conclusions are sufficient in itself for those in a hurry. It consists of 30 pages of analysis presented very clearly in new infographics, images and tables including markets that will drop, not just the rosy picture. No nostalgia or rambling text because the focus is business opportunities 2023-2043. Then come 23 pages of forecasts and roadmaps including background forecasts such as those for the smartphones, base stations etc. needing your products.

Chapter 2. “Current situation, changing needs, new options 2023-2043” takes 52 pages to surface the many needs for better cooling, the new approaches to this and the companies involved. The rest of the report analyses the technologies linked to emerging needs. All highlight the most popular materials, structures and targetted new applications in the latest research pipeline with Zhar Research analysis. That includes solutions for smart cities, 6G Communications in two phases from 2030 and next data centers.

Chapter 3. “Passive radiative and heat sink radiative/ convective cooling, passive liquid cooling: emerging materials and devices toolkit 2023-2043” needs 53 pages because so much is happening with next radiative and convective passive cooling. Most is on that busy radiative cooling sector because most convective cooling involves active approaches to forced air and liquid covered in a sister report on active cooling, though the renewed interest in passive immersion cooling and other options are covered. The closely linked subjects of metamaterial and advanced optronic cooling having their own chapter.

Chapter 4 addresses “Passive conductive cooling: emerging materials and devices toolkit 2023-2043”. In 43 pages it addresses needs from heavy industry to cooling quantum dots and particularly focuses on design issues, emerging thermal interface materials, morphologies and next polymer choices, blends and particulate additives. Here is graphite in thermally conductive concrete, as annealed pyrolytic forms, even graphene arriving for example.

Chapter 5 “Passive phase change cooling: evaporative, heat pipe, solid state: emerging materials and devices toolkit 2023-2043” needs 52 pages to make sense of this exceptionally active area. It particularly addresses cooling by latent heat of evaporation and melting in both closed systems such as heat pipes and the trending vapor chambers and open systems.. See microscale heat pipes for the imminent one-kilowatt microchips, hydrogel cooling evolving from medical and cosmetic patches to building applications. Importantly, here are options for phase change cooling of all those solar panels arriving.

Chapter 6 at 22 pages explains the magic of metamaterials and advanced optronic devices. They will even create the opposite of a greenhouse and of a magnifying glass concentrating the sun to create a fire. Yes – cooling in both cases. As in the other chapters, all assertions are backed by many research papers, particularly the latest from 2023.

Chapter 7 presents your opportunities from the trend to multi-mode cooling such as that ICER and practical forms of PDRC. Called, “Passive multi–mode, multi-purpose integrated cooling” it also covers multipurpose subsystems, even multipurpose materials called structural electronics and multifunctional composites which may do the cooling task but double for load-bearing, optical and other functions as with the many emerging forms of window that passively cool. Only 25 pages for that because so many have been covered in earlier chapters.

Your opportunities for passive cooling materials, subsystems and complete products will span more that the typical coverage of other reports, making the unique Zhar Research report, “Passive cooling materials and devices: new markets 2023-2043” essential reading. It is constantly updated so, at the time of purchase, you get the latest in this rapidly evolving subject.