Long Duration Energy Storage LDES Beyond Grids: Markets, Technologies for Microgrids, Minigrids, Buildings, Industrial Processes 0.1-500MWh 2024-2044

PDF Download Report

Single User License - Allowing one user access to the product.

Site License - Allowing all users within a given geographical location of your organisation access to the product.

Enterprise License - Allowing all employess within your organisation access to the product.

PDF Download Report

Single User License - Allowing one user access to the product.

Site License - Allowing all users within a given geographical location of your organisation access to the product.

Enterprise License - Allowing all employess within your organisation access to the product.

PDF Download Report

Single User License - Allowing one user access to the product.

Site License - Allowing all users within a given geographical location of your organisation access to the product.

Enterprise License - Allowing all employess within your organisation access to the product.

Sample Pages

Contents List

-

1.1 Purpose of this report

1.2 Methodology of this analysis

1.3 Overview

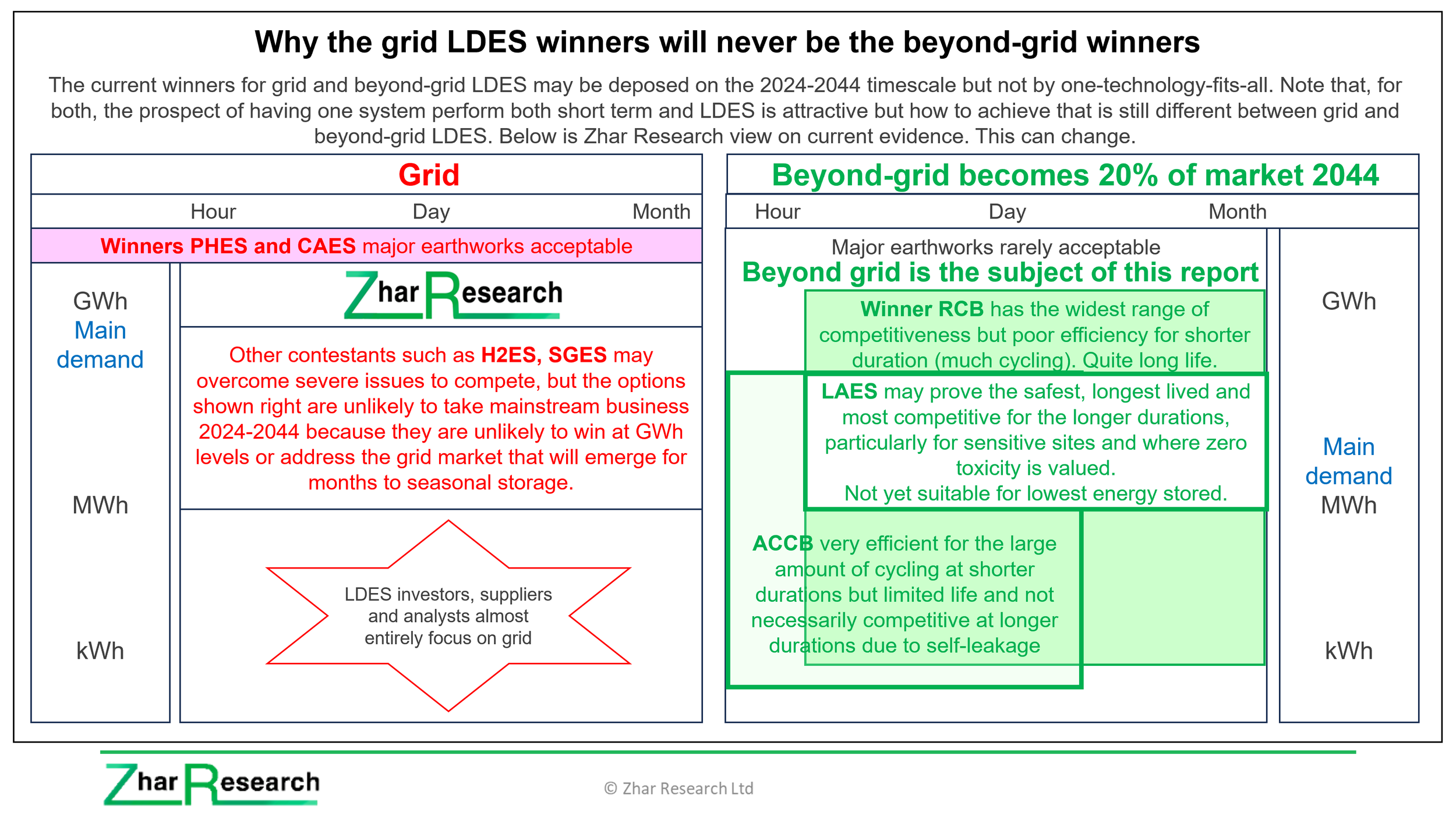

1.4 The different characteristics of grid utility and beyond-grid LDES 2024-2044

1.5 10 primary conclusions concerning the beyond-grid LDES market

1.6 10 primary conclusions concerning the beyond-grid LDES technologies

1.7 Beyond-grid LDES roadmap 2024-2044

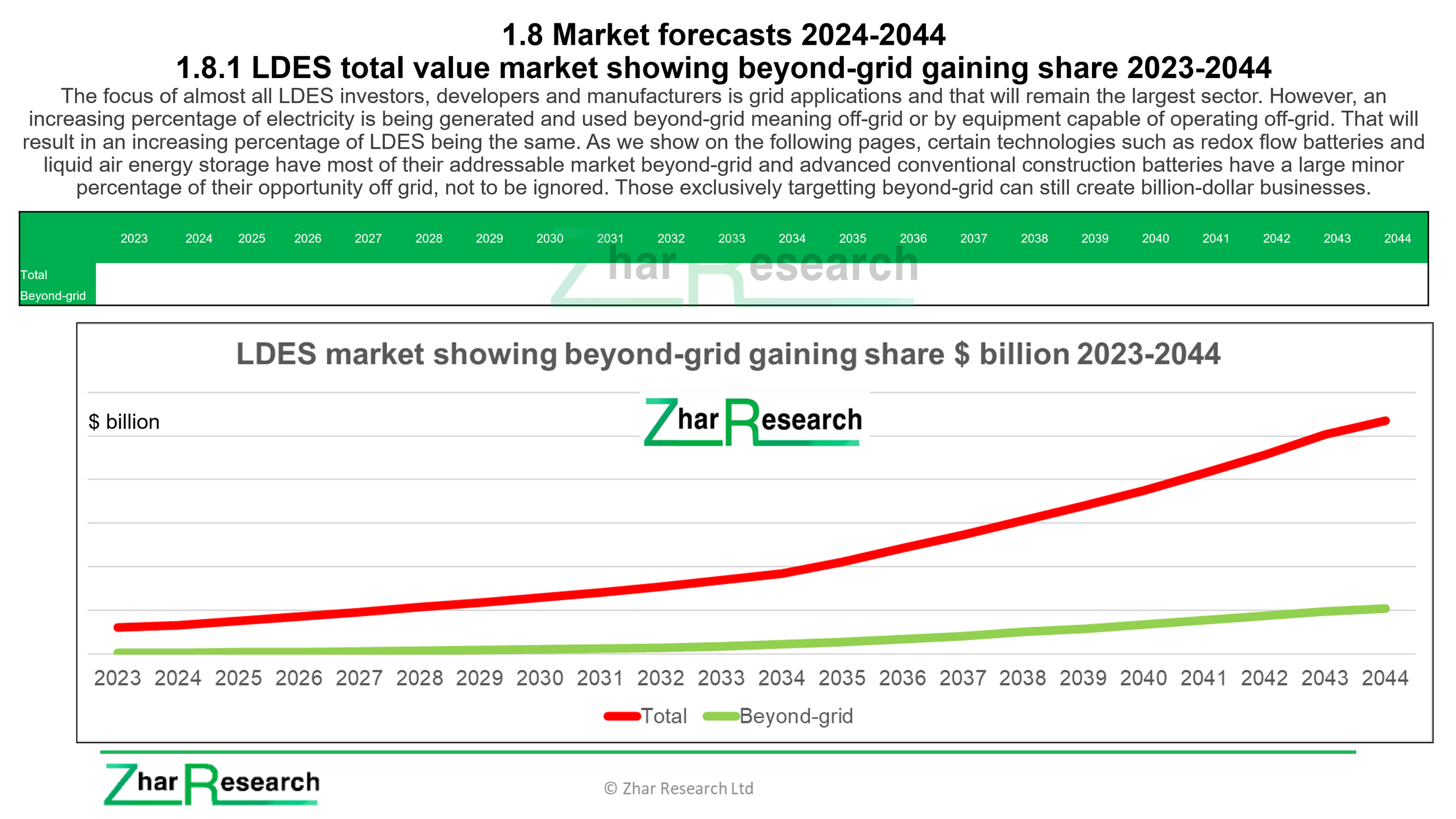

1.8 Market forecasts 2024-2044 1.8.1 LDES total value market showing beyond-grid gaining share 2023-2044

1.8.2 Beyond-grid LDES market for microgrids, minigrids, other in 8 categories $ billion 2023-2044: table and line graphs

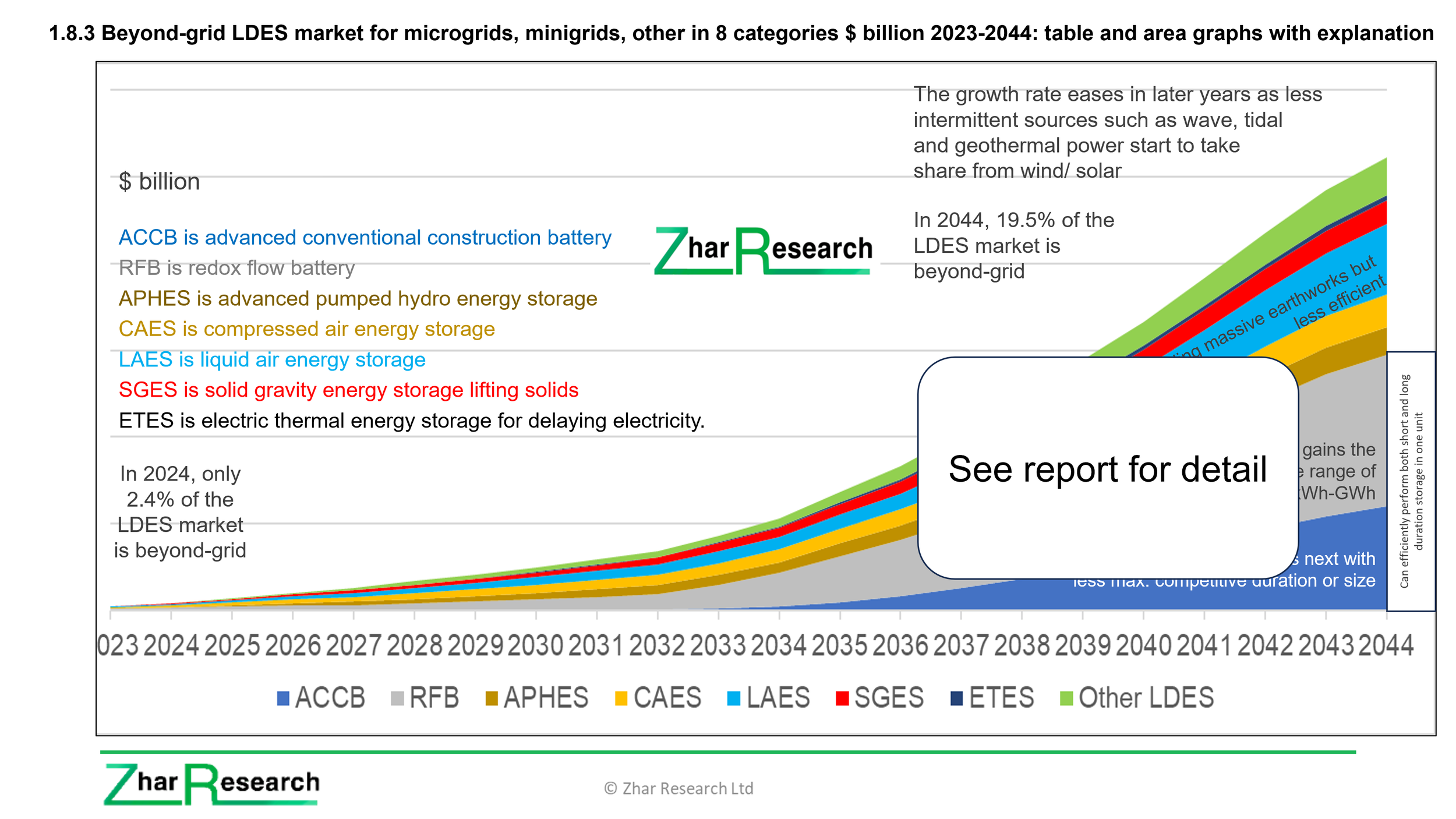

1.8.3 Beyond-grid LDES market for microgrids, minigrids, other in 8 categories $ billion 2023-2044: table and area graphs with explanation

1.8.4 Regional share of beyond-grid LDES value market in four categories 2024-2044

1.8.5 Total LDES market in 11 technology categories $ billion 2023-2044 table and graphs

1.8.6 Microgrid/ minigrid market 2024-2044

-

2.1 Overview

2.1.1 LDES

2.1.2 Global electricity trends

2.1.3 Beyond-grid: buildings, industrial processes, minigrids, microgrids, other

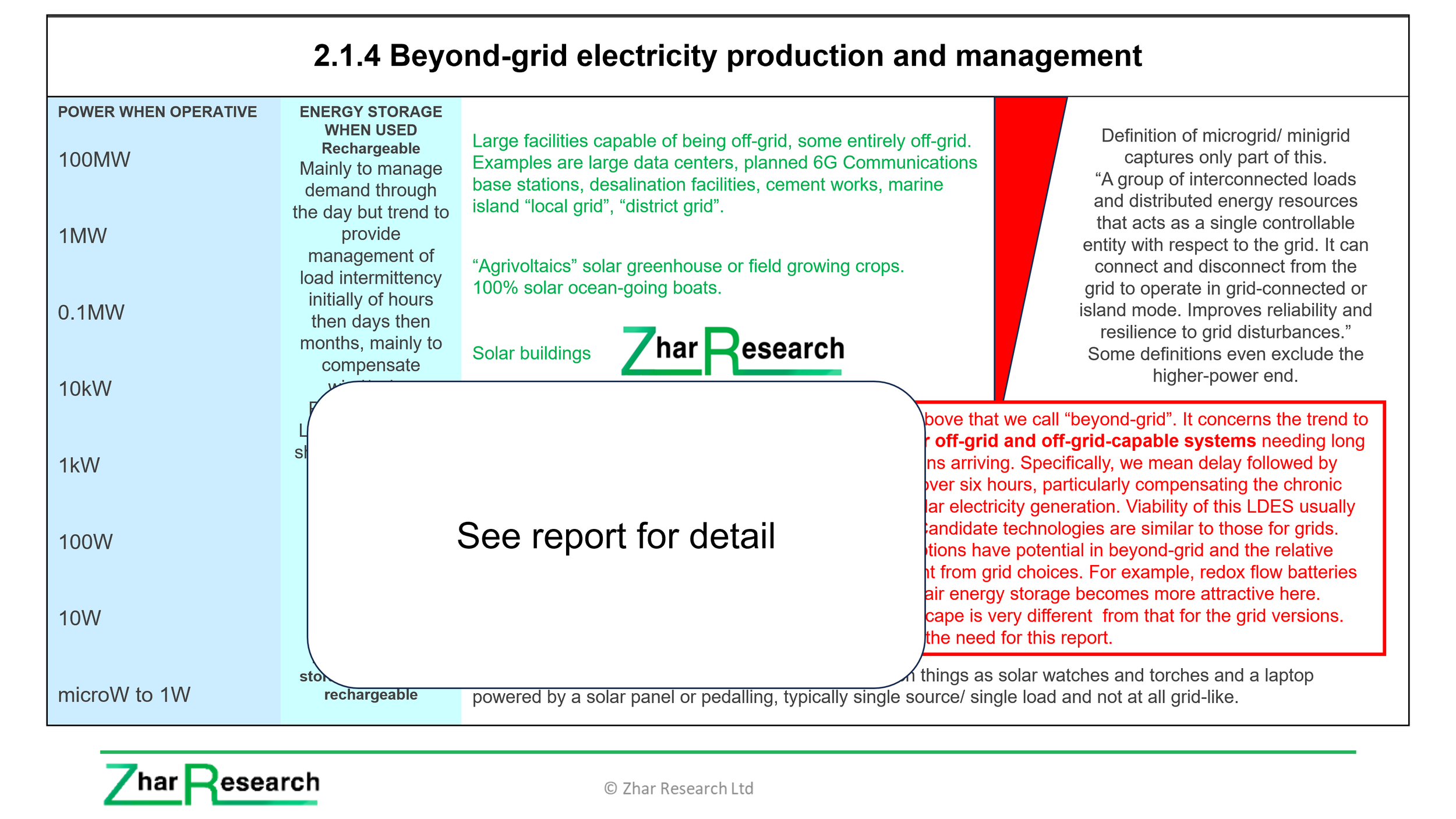

2.1.4 Beyond-grid electricity production and management

2.2 The off-grid megatrend

2.3 The solar megatrend

2.4 The LDES prospect and cost challenge 2.4.1 Prospect

2.4.2 Challenge: compelling economics for local provision of LDES

2.4.3 Example of avoiding LDES by input matching: Ushant island

2.4.4 Reducing LDES need: Photovoltaics can provide more even power over more of the day

2.4.5 The trend to needing longer duration storage

2.4.6 LDES cost challenge

2.5 Multifunctional nature of beyond-grid storage

2.6 Big picture of LDES technology potential for grid and beyond-grid

2.7 LDES toolkit for grid and beyond-grid

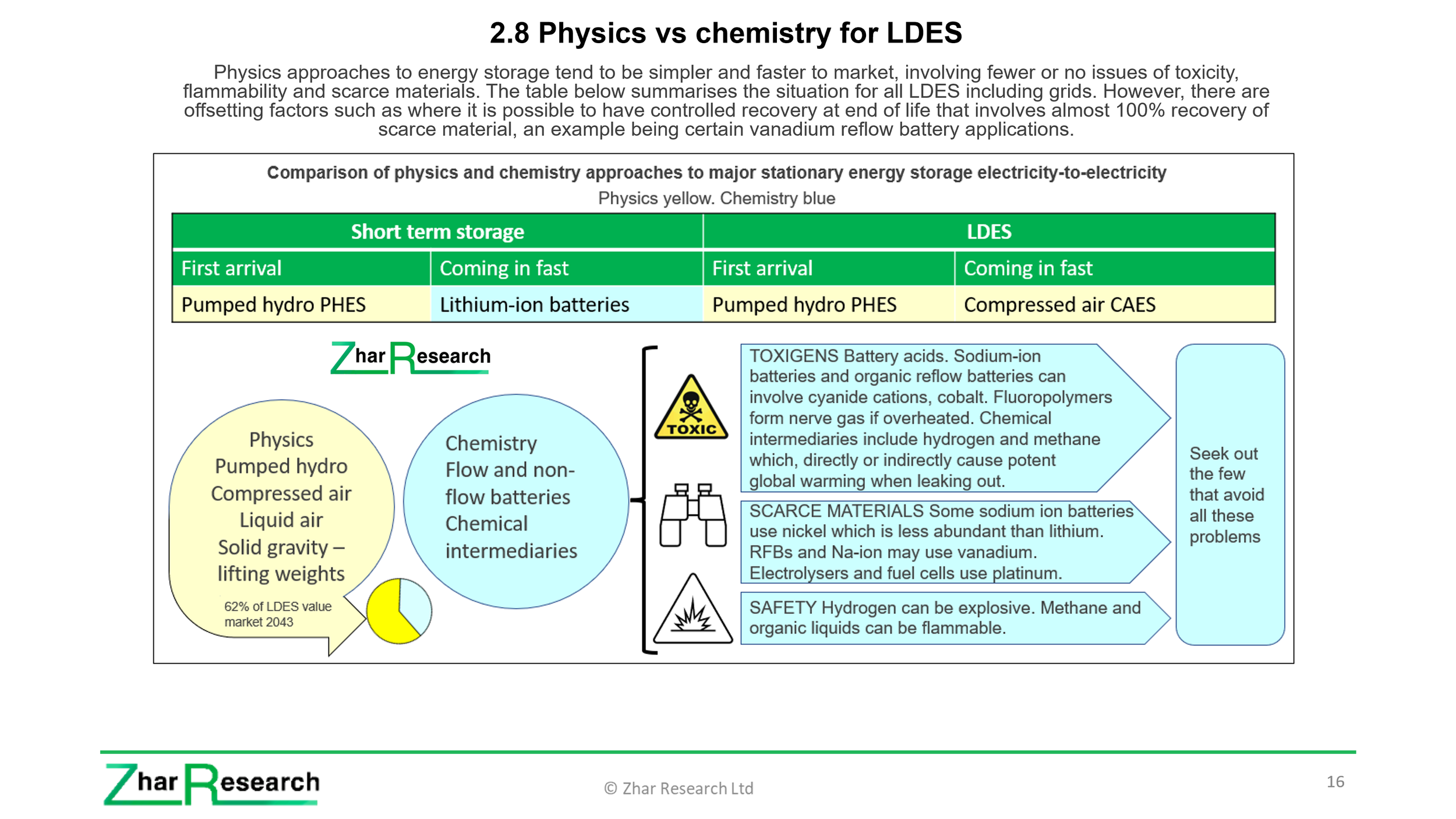

2.8 Physics vs chemistry for LDES

2.9 Technologies for largest number of LDES sold for grids, microgrids, buildings 2024-2044

-

3.1 Overview and definition and usefulness of LCOS

3.2 Equivalent efficiency vs storage hours, LCOS calculation, 9 technology families, vs 17 criteria

3.3 Nine LDES technology families, vs 17 other criteria

3.4 LDES technology choices including for grids

3.5 Lessons from LDES projects completed and planned

3.6 Available sites vs space efficiency for LDES technologies

3.7 LCOS $/kWh trend vs storage and discharge time

3.8 LDES power GW trend vs storage and discharge time

3.9 Days storage vs rated power return MW for LDES technologies

3.10 Days storage vs capacity MWh for LDES technologies

3.11 Potential by technology to supply LDES at peak power after various delays

-

4.1 Overview

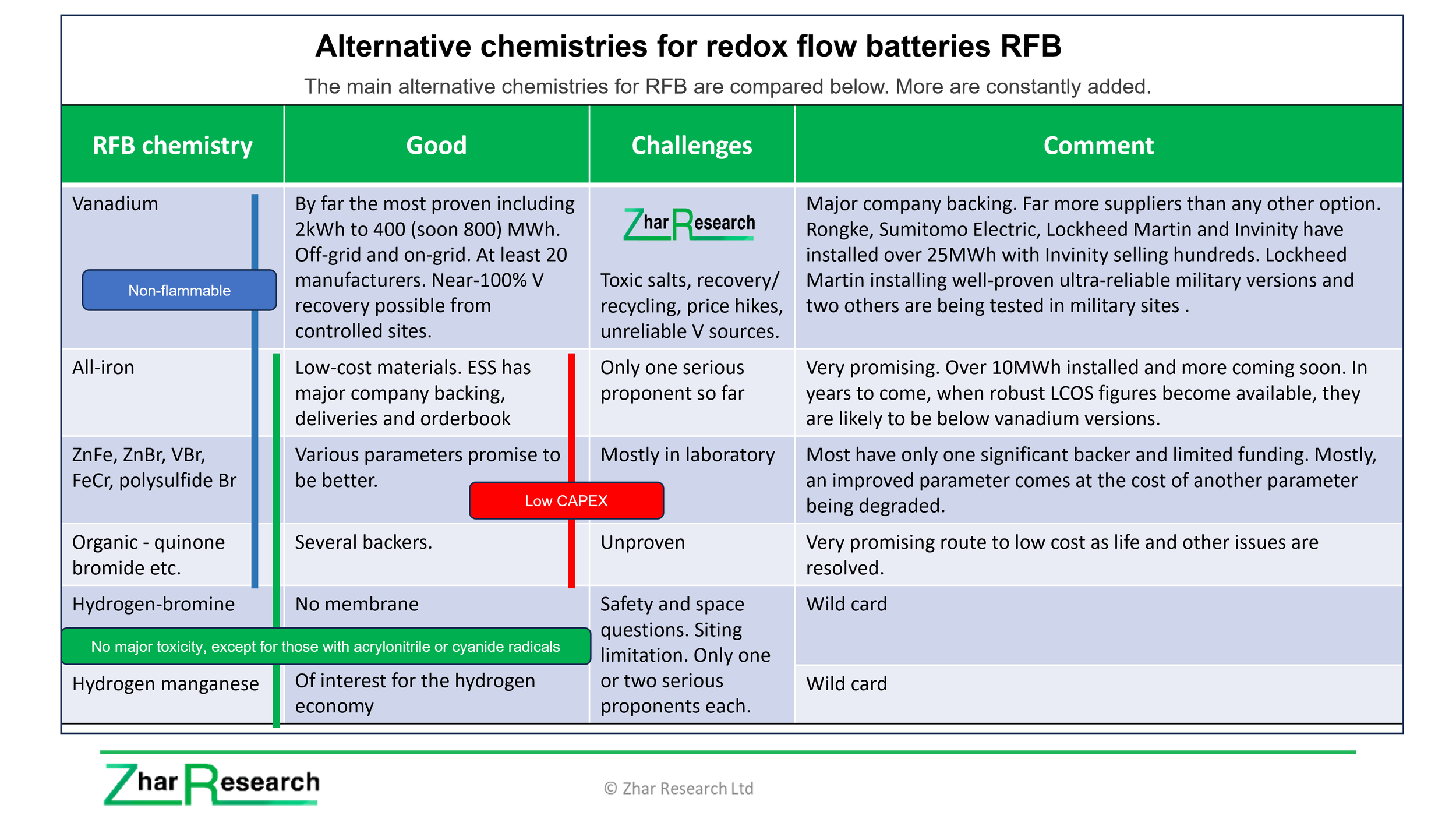

4.2 RFB technologies

4.3 SWOT appraisal of RFB for stationary storage

4.4 SWOT appraisal of RFB energy storage for LDES

4.5 Parameter appraisal of RFB for LDES

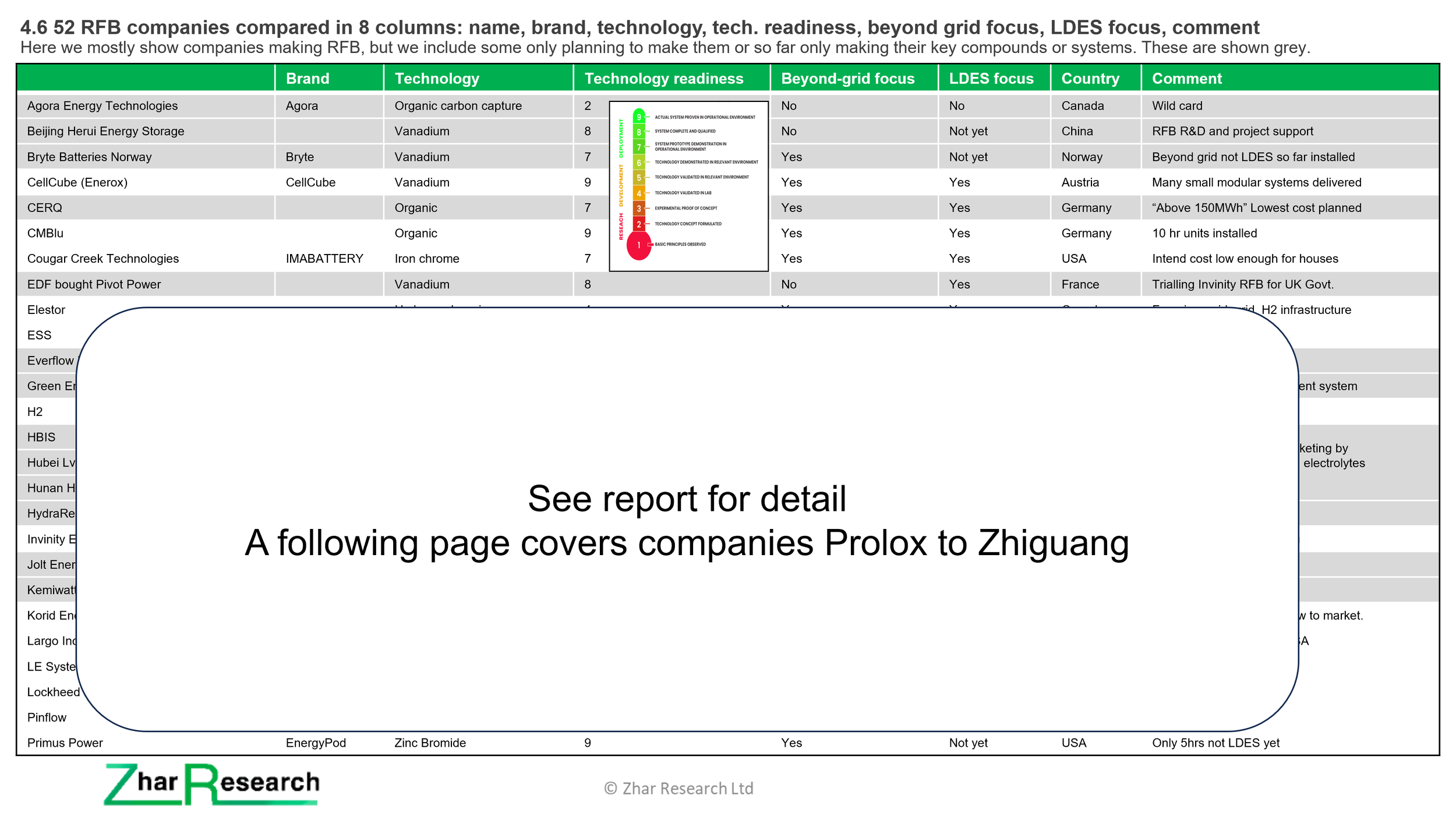

4.6 52 RFB companies compared in 8 columns: name, brand, technology, tech. readiness, beyond grid focus, LDES focus, comment

4.7 Detailed profiles of 52 RFB companies in 92 pages

4.8 Research thrust

-

5.1 Overview

5.2 SWOT appraisal of ACCB for LDES

5.3 Parameter comparison of ACCB for LDES

5.4 Iron-air

5.5 Molten metal

5.6 Nickel hydrogen

5.7 Sodium sulfur

5.8 Zinc

5.10 Other

-

6.1 Overview

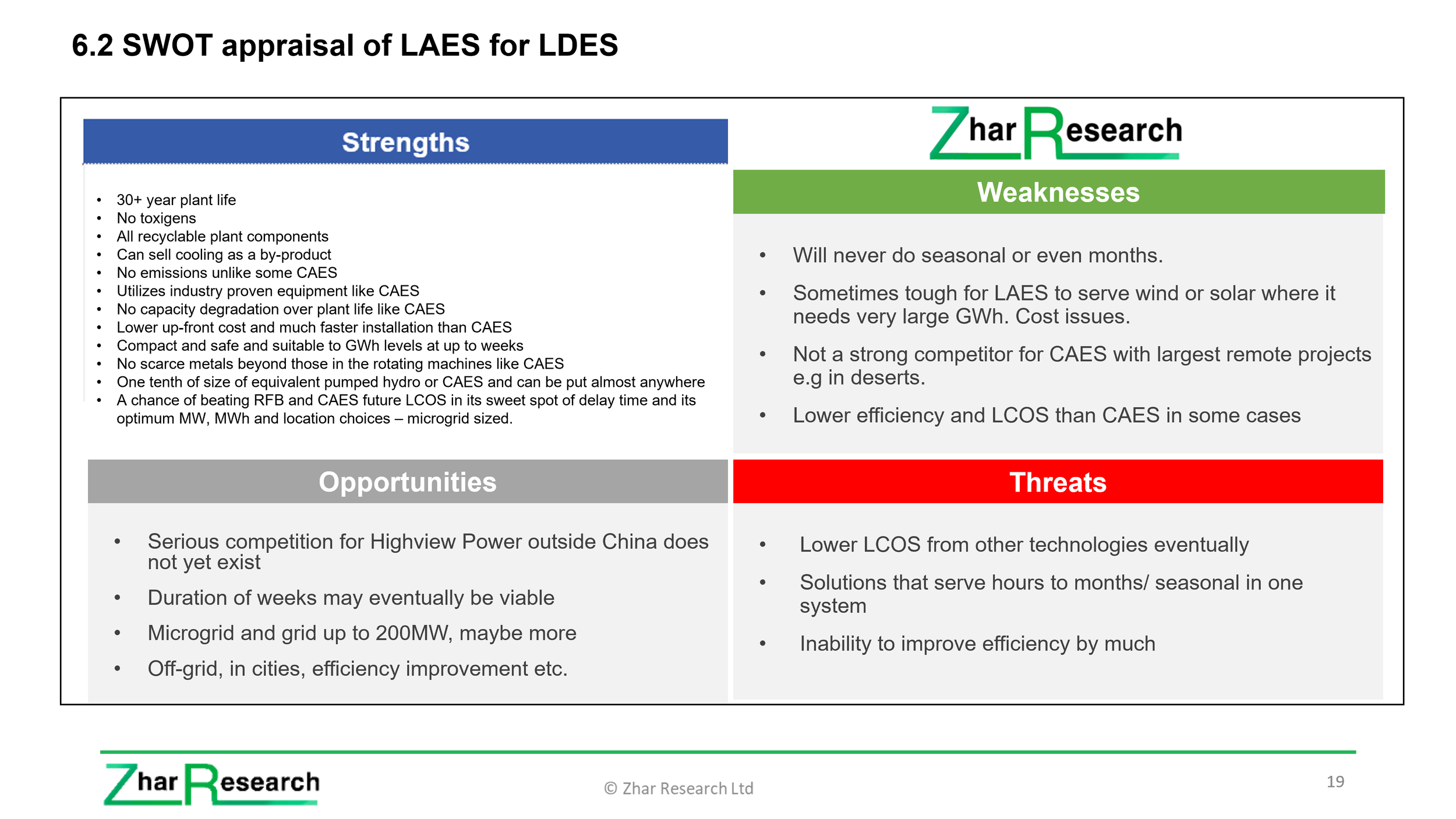

6.2 SWOT appraisal of LAES for LDES

6.3 SWOT appraisal of liquid carbon dioxide for LDES

6.4 Parameter comparison of liquid gas for LDES

6.5 Liquid air energy storage technology, markets, achievements and prospects

6.5 Liquid carbon dioxide storage technology, markets, achievements and prospects

-

7.1 Overview

7.2 APHES with SWOT appraisal

7.3 CAES with SWOT appraisal

7.4 ETES with SWOT appraisal

7.5 SGES with SWOT appraisal

-

8.1 Overview

8.2 H2ES with beyond-grid LDES SWOT appraisal

8.3 PHES with beyond-grid LDES SWOT appraisal

Chapters 8

SWOT appraisals 10

Forecast lines 2024-2044 26

Companies Over 75

Infograms, tables, graphs 123

Pages 300

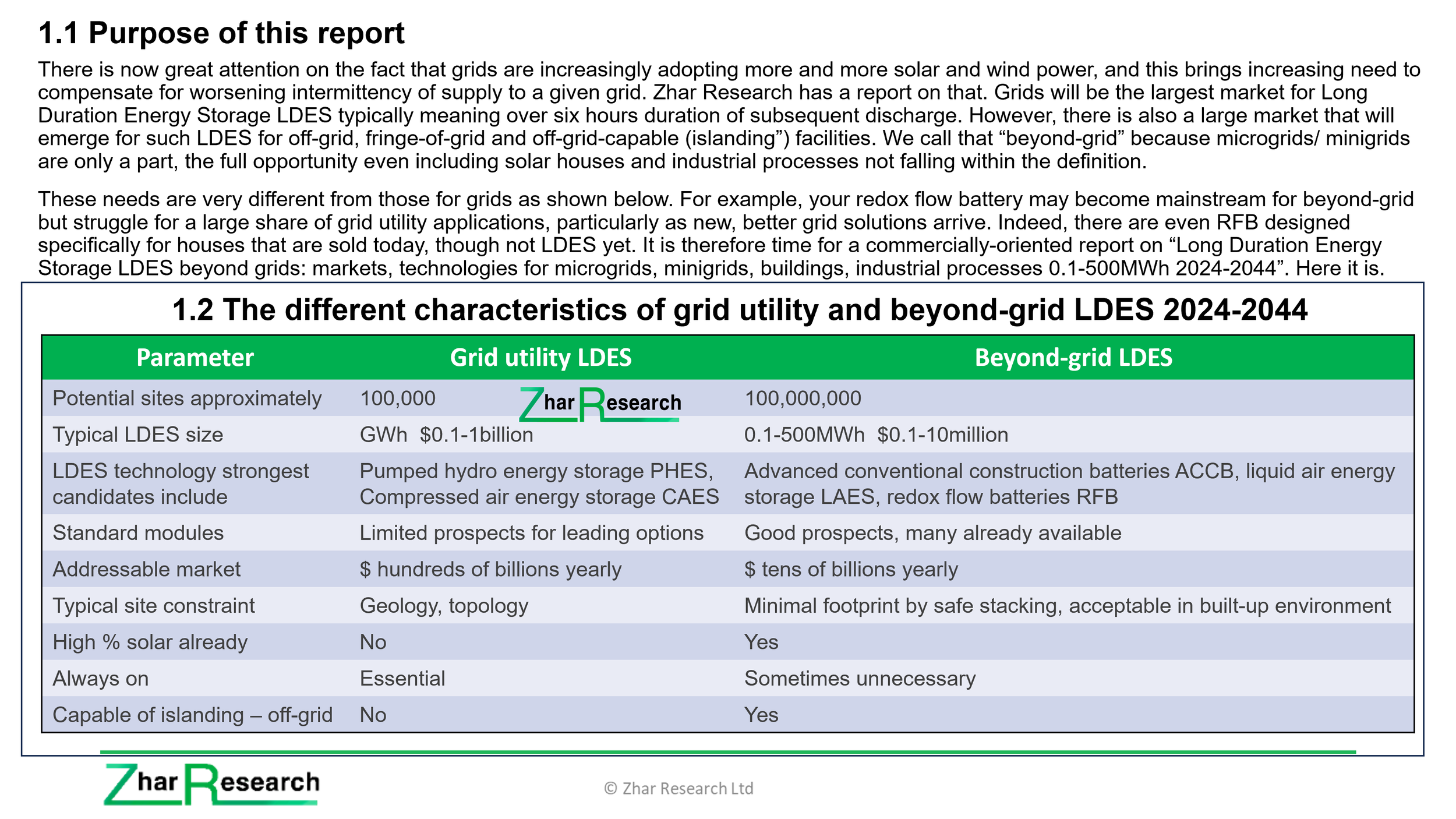

Long Duration Energy Storage LDES mostly refers to delayed electricity to cover increased intermittency as grids adopt more solar and wind power. For the first time a report analyses the very different needs and technologies for LDES beyond grids. It is the 300-page, Zhar Research report, “Long Duration Energy Storage LDES beyond grids: markets, technologies for microgrids, minigrids, buildings, industrial processes 0.1-500MWh 2024-2044”.

Dr Peter Harrop, CEO of Zhar Research says,

“The very idea of a grid involves power supplied anywhere on the system so GWh storage attracts even when it involves massive earthworks such as pumped hydro and underground compressed air and hydrogen. For LDES, there is also some place for advanced batteries, conventional or redox flow, and liquid gas storage but the tables are turned when you go off grid or to systems only using grid as backup. These smaller systems are in many sensitive locations so forget the massive earthworks and prioritise aspects such as modules, small footprint from being stackable, extreme safety and rapid installation even in buildings. Then the weaker contestant become the dominant players.

“This beyond-grid market of under $0.5 billion today becomes over $52 billion in 2044 on our analysis. A powerful driver of this is the megatrend to making electricity yourself and where you need it – seeking empowerment, security and predictability of costs. Indeed, these beyond-grid systems already average a higher percentage of solar power, and therefore that intermittency, than is seen in grids. However, wind power is less prevalent so this is a very different market. Companies such as Invinity and CellCube have already installed hundreds of appropriate units, initially short duration, but now increasingly to meet the need for 12 hours duration of delayed discharge with one month in prospect. Others with appropriate technology for beyond-grid are mostly slogging it out in the grid space, missing what will be their best opportunity, and one with less competition.”

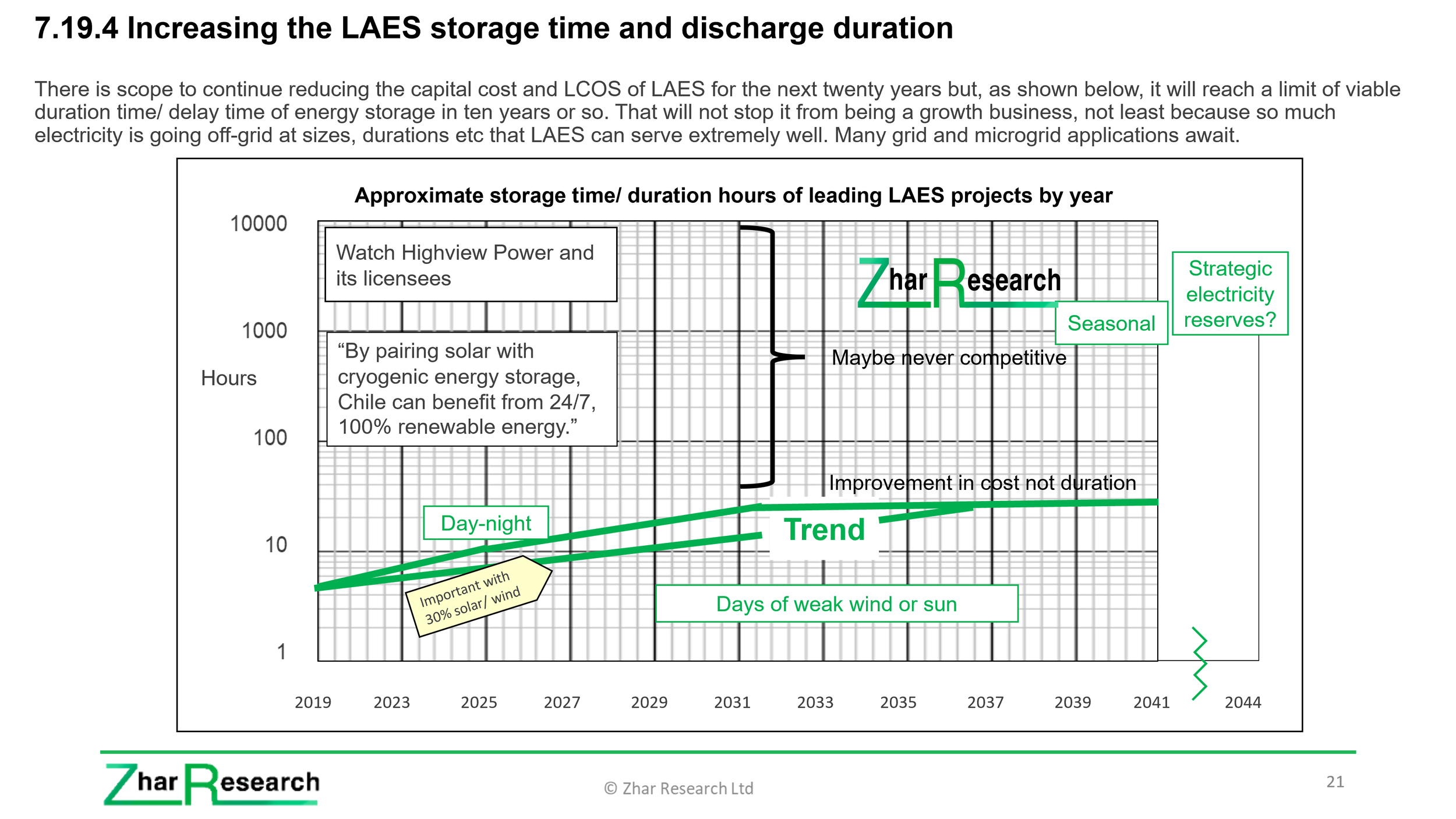

Zhar Research finds that, unlike grids, there may never be much demand for seasonally-delayed electricity with months of subsequent discharge in beyond-grid applications. However, Zhar Research finds that about one month of delay and subsequent discharge will become a large, additional beyond-grid LDES business, causing some technologies to fall by the wayside.

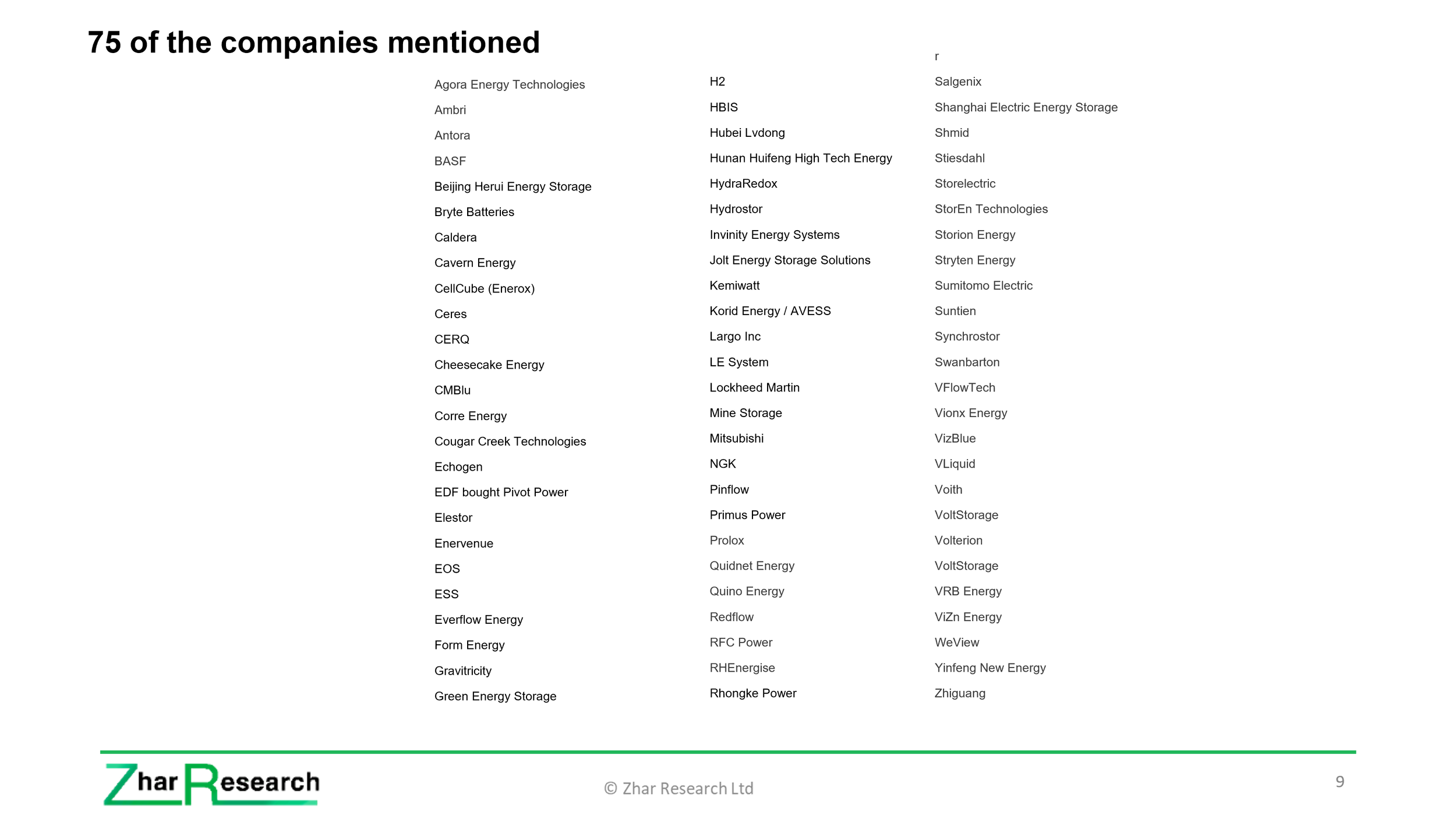

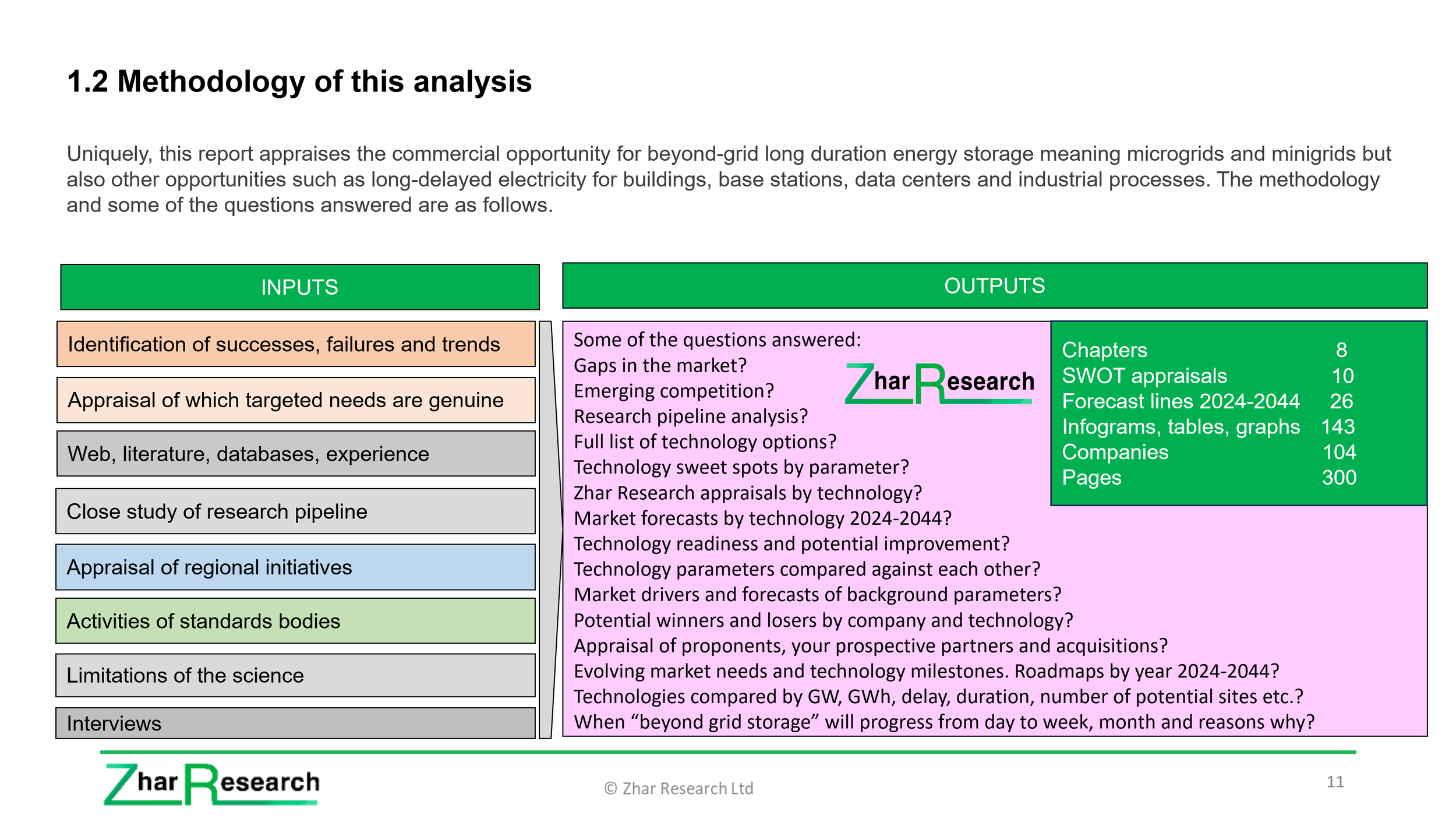

Uniquely, the report looks very closely at this technology roadmap, research pipeline and intended product launches. It gives 2024-2044 forecasts in 26 lines and compares and profiles a remarkable 52 RFB players, to take one promising example. There are many parameter infograms and projections putting the beyond-grid LDES opportunity in the context of the total LDES opportunity with numbers for both.

The 28-page executive summary and conclusions gives the basics, 20 key conclusions, those 26 forecasts, a detailed 2024-2044 roadmap, sufficient in itself. The 22-page Introduction is mostly new infograms introducing LDES, chemistry vs physics approaches and ways of reducing the need for LDES because this is a balanced view. Understand how beyond-grid is much more than microgrids and minigrids, see data and trends for wind, solar and other intermittency and the cost issues.

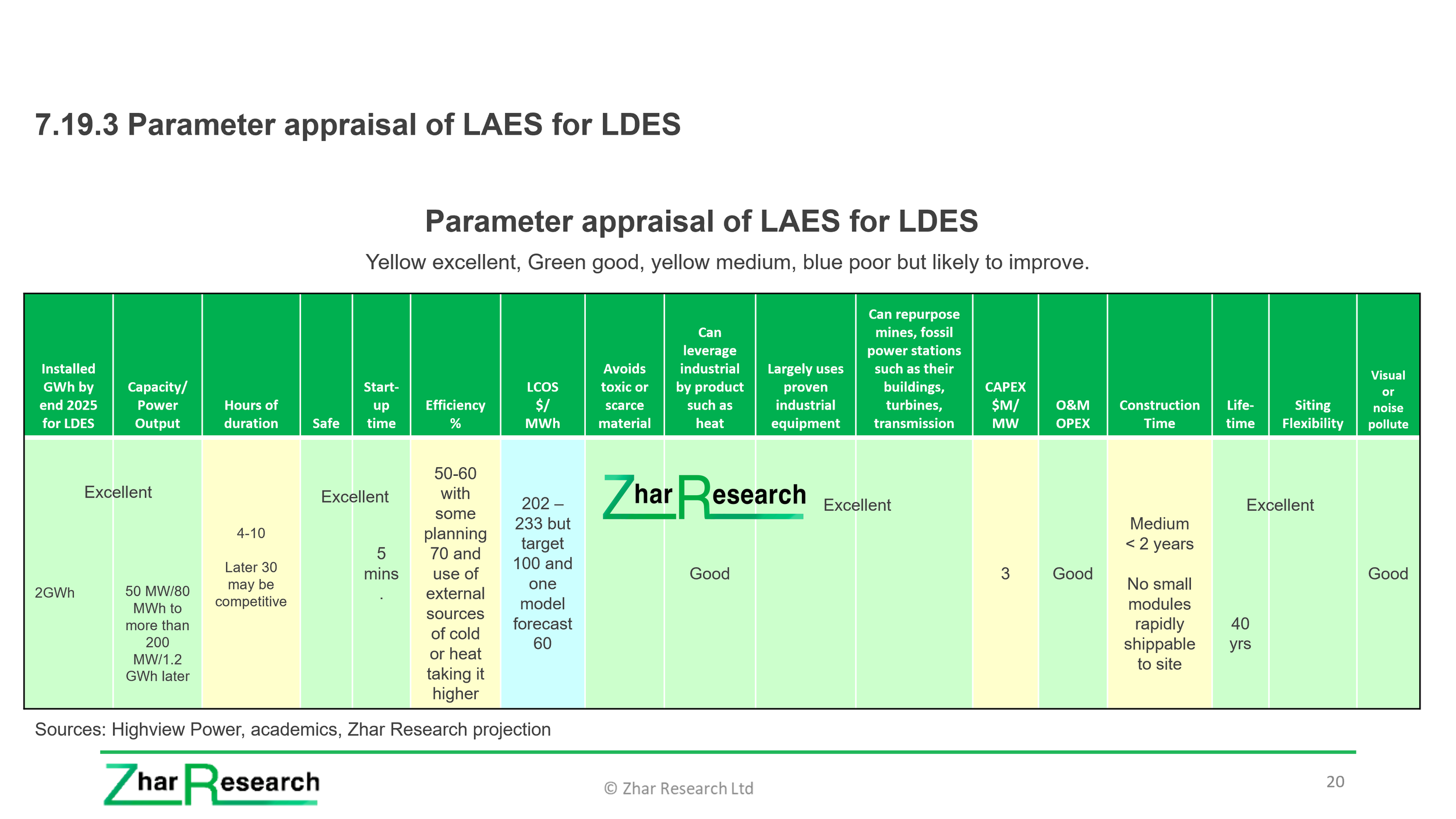

Chapter 3. “LDES storage options compared by parameter” is 13 pages mostly presenting new, detailed graphs, infograms and tables comparing and criticising the options. For instance one table compares nine LDES technology families, vs 17 criteria and an infogram then gives more. Levelised cost of storage LCOS is explained and a page explains and plots LCOS $/kWh trend vs storage and discharge time for the many options. Absorb 13 close-packed pages.

Chapter 4 requires a massive 110 pages to cover “Primary LDES options beyond grids: Redox flow batteries RFB” because these are so important for beyond-grid while their grid LDES opportunity may be threatened by arriving giant options. The many RFB chemistries are assessed and the progress so far. 52 RFB players are compared in eight columns but also in extensive separate profiles with images, text and Zhar Research appraisals. There is an overall RFB SWOT appraisal and one for each of the main chemistries.

Chapter 5 “Primary LDES options beyond grids: Advanced conventional construction batteries ACCB” takes 45 pages to appraise beyond grid LDES in the form of sodium sulfur, iron-air, zinc, molten metal, nickel-hydrogen and other batteries. Learn how many have better LDES options beyond grid. Again, the emphasis is commercial opportunity 2024-2044, with company profiles, intentions, SWOT appraisals and parameter comparisons. The 25 pages of Chapter 6 give the same treatment to liquid gas in the form of liquid air and liquid carbon dioxide versions.

The other options mostly have severe siting restrictions which is little problem with grids but more restrictive with beyond-grid with its large number and variety of sites that must be capable of being independent. Nonetheless, some of these other options will gain business. The report therefore has 80 pages as Chapter 7. “Other LDES storage options beyond grids: SGES, APHES, ETES”. For example, although solid gravity storage SGES by Energy Vault involves massive grid facilities, Gravitricity goes smaller by re-purposing a Czechia mineshaft, having identified 14,000 disused mine shafts that could be swiftly turned over to gravity-based energy storage. In this chapter we cover how advanced pumped hydro energy storage APHES is specifically aimed at avoiding the severe siting and permitting restrictions of traditional pumped hydro but, on current evidence, it will still be more appropriate for grids than off-grid is successful. Smallest sizes of most of these is problematic. If you plan a water tank on your house for LDES, expect only the power of an AA battery which is clearly nonsense.

The report closes with technologies only very rarely are likely to be optimal for beyond-grid. This is mainly because they either require massive underground storage or involve severe safety issues. However, “Never say Never”, so we use a brief 10 pages for the Chapter 8. “Less potential for beyond-grid: CAES, H2ES, conventional PHES” explaining why, but acknowledging that the situation may change.

In short, the beyond-grid LDES market is largely neglected because, so far, it is a small business. That is your opportunity because it will become a very large business where many companies can succeed if they address these very-different needs, even creating billion-dollar enterprises. Uniquely, the Zhar Research report, “Long Duration Energy Storage LDES beyond grids: markets, technologies for microgrids, minigrids, buildings, industrial processes 0.1-500MWh 2024-2044” shows the way. It is useful for investors, materials suppliers, LDES manufacturers and governments.