Active Cooling: Large New Materials, Systems Markets 2023-2043

PDF Download Report

Single User License - Allowing one user access to the product.

Site License - Allowing all users within a given geographical location of your organisation access to the product.

Enterprise License - Allowing all employess within your organisation access to the product.

PDF Download Report

Single User License - Allowing one user access to the product.

Site License - Allowing all users within a given geographical location of your organisation access to the product.

Enterprise License - Allowing all employess within your organisation access to the product.

PDF Download Report

Single User License - Allowing one user access to the product.

Site License - Allowing all users within a given geographical location of your organisation access to the product.

Enterprise License - Allowing all employess within your organisation access to the product.

Sample Pages

Contents List

-

1A Purpose, definitions, methodology, needs, technologies

1.1 Purpose of this report

1.2 Methodology

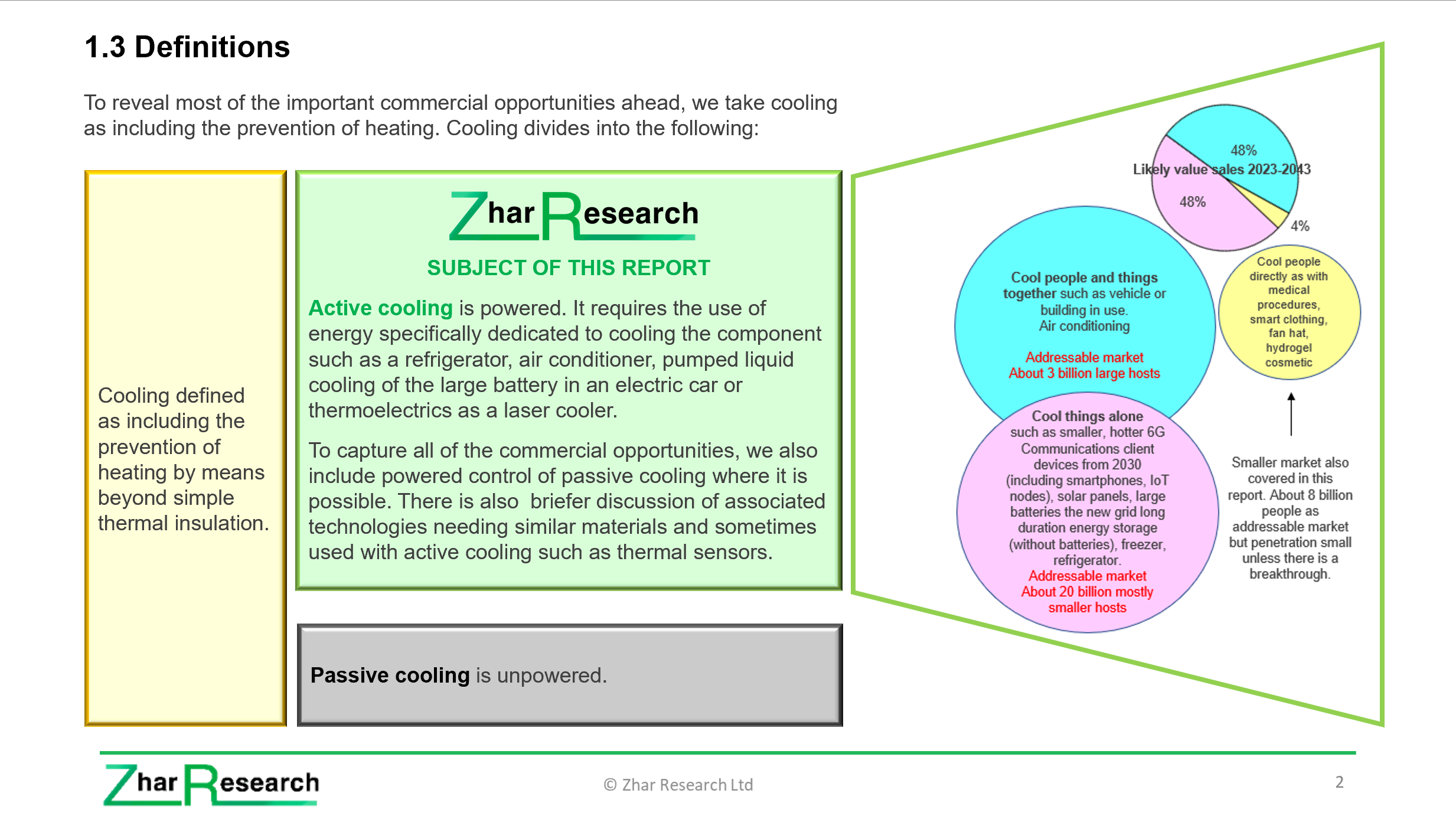

1.3 Definitions

1.4 Infogram: Major new cooling and thermal management needs arrive 2023-2043

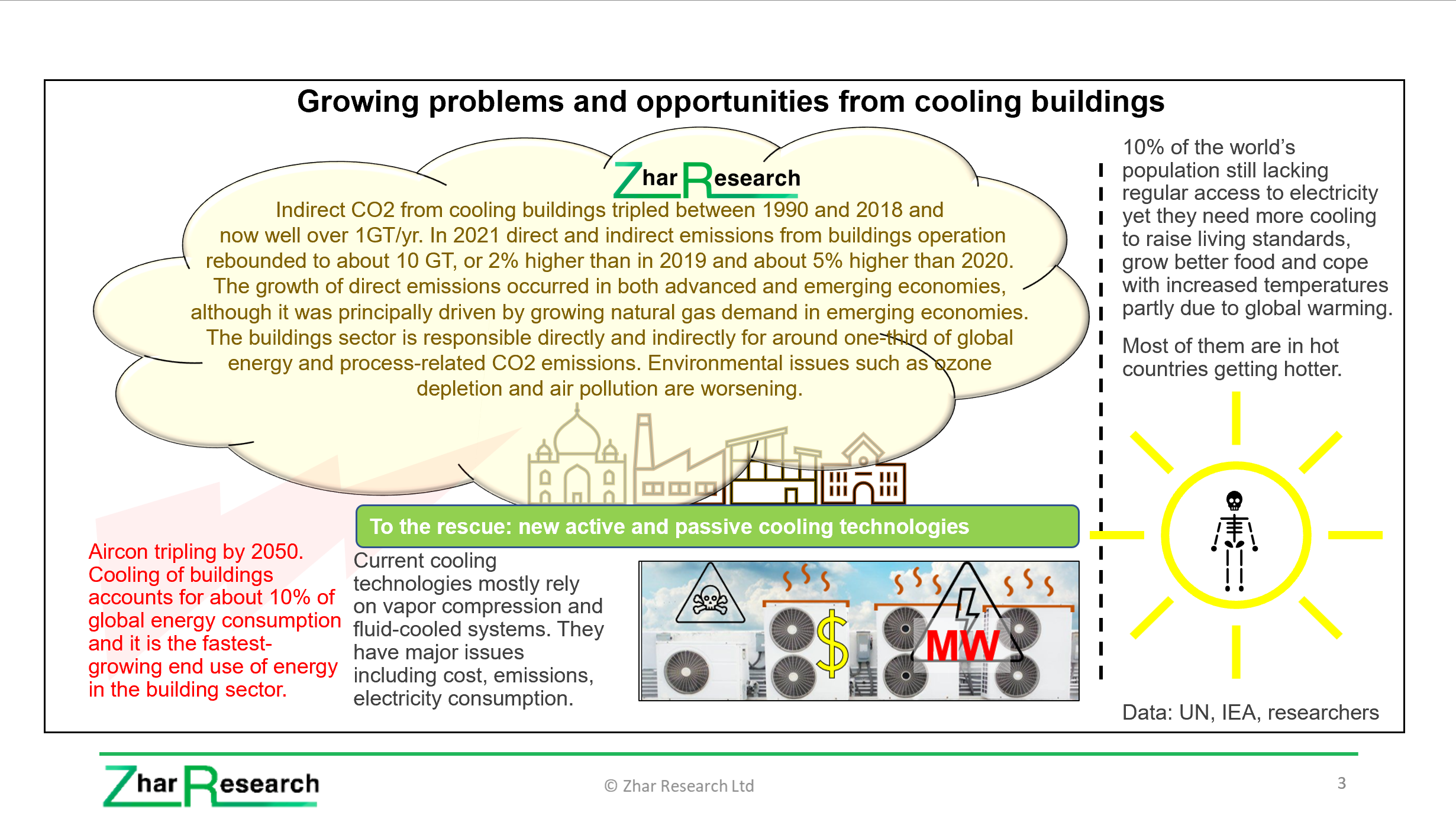

1.4.1 Three infograms: Unsustainable growth in conventional air conditioning, refrigerators, freezers

1.4.2 Electric vehicles land, water and air create major new needs

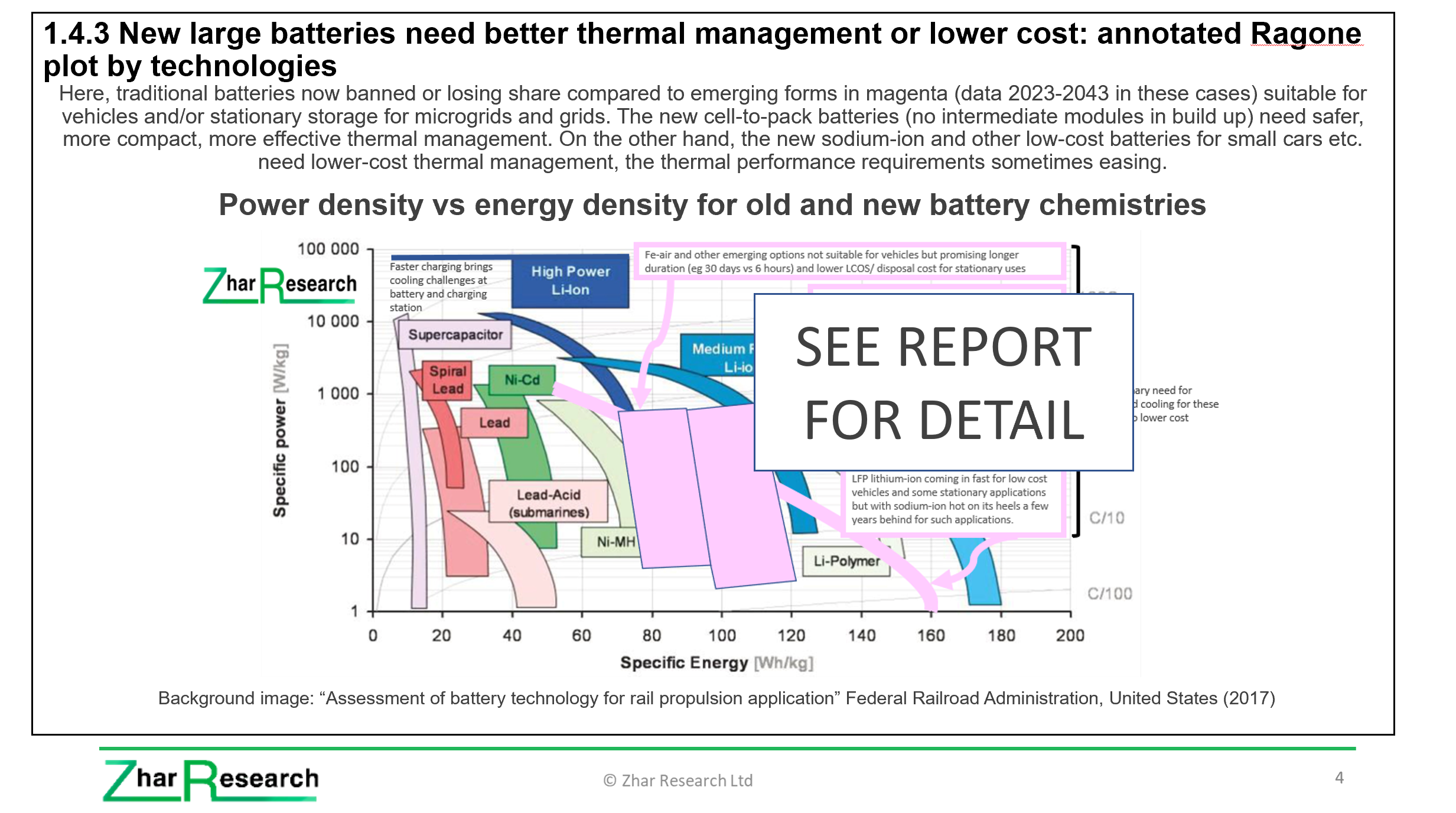

1.4.3 New large batteries need better thermal management or lower cost: annotated Ragone plot by technologies

1.4.4 Grid batteries and Long Duration Energy Storage LDES create major new markets for thermal management

1.4.5 How Long Duration Energy Storage LDES will create major new demand for active cooling

1.4.6 Cooling the power hungry new processors, power electronics for grids, microgrids, telecoms.

1.4.7 How 6G Communications will bring major new active cooling demand

1.4.8 Why data centers will need more active cooling

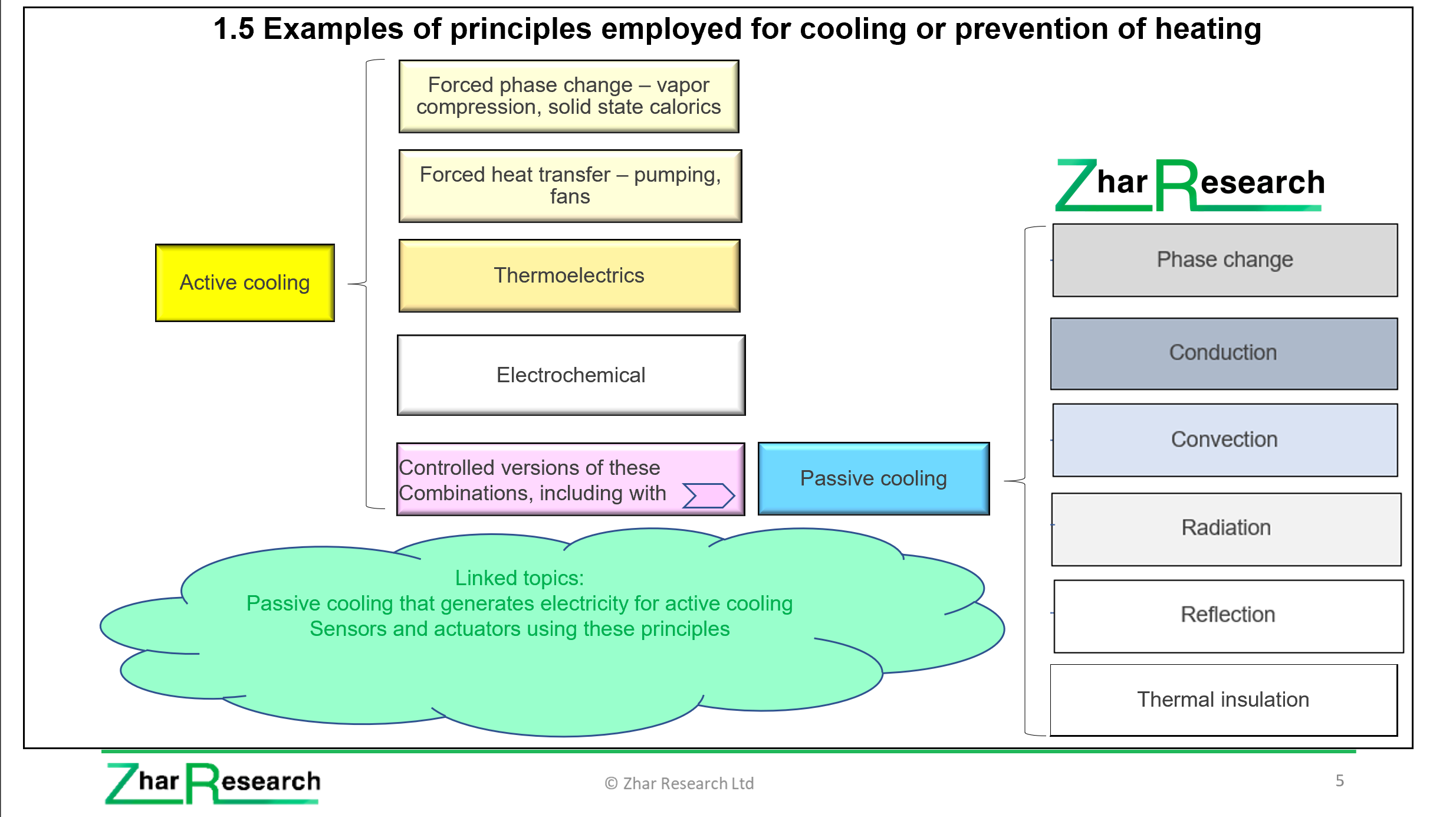

1.5 Examples of principles employed for cooling or prevention of heating

1.5.1 Options for cooling and prevention of heating beyond thermal insulation

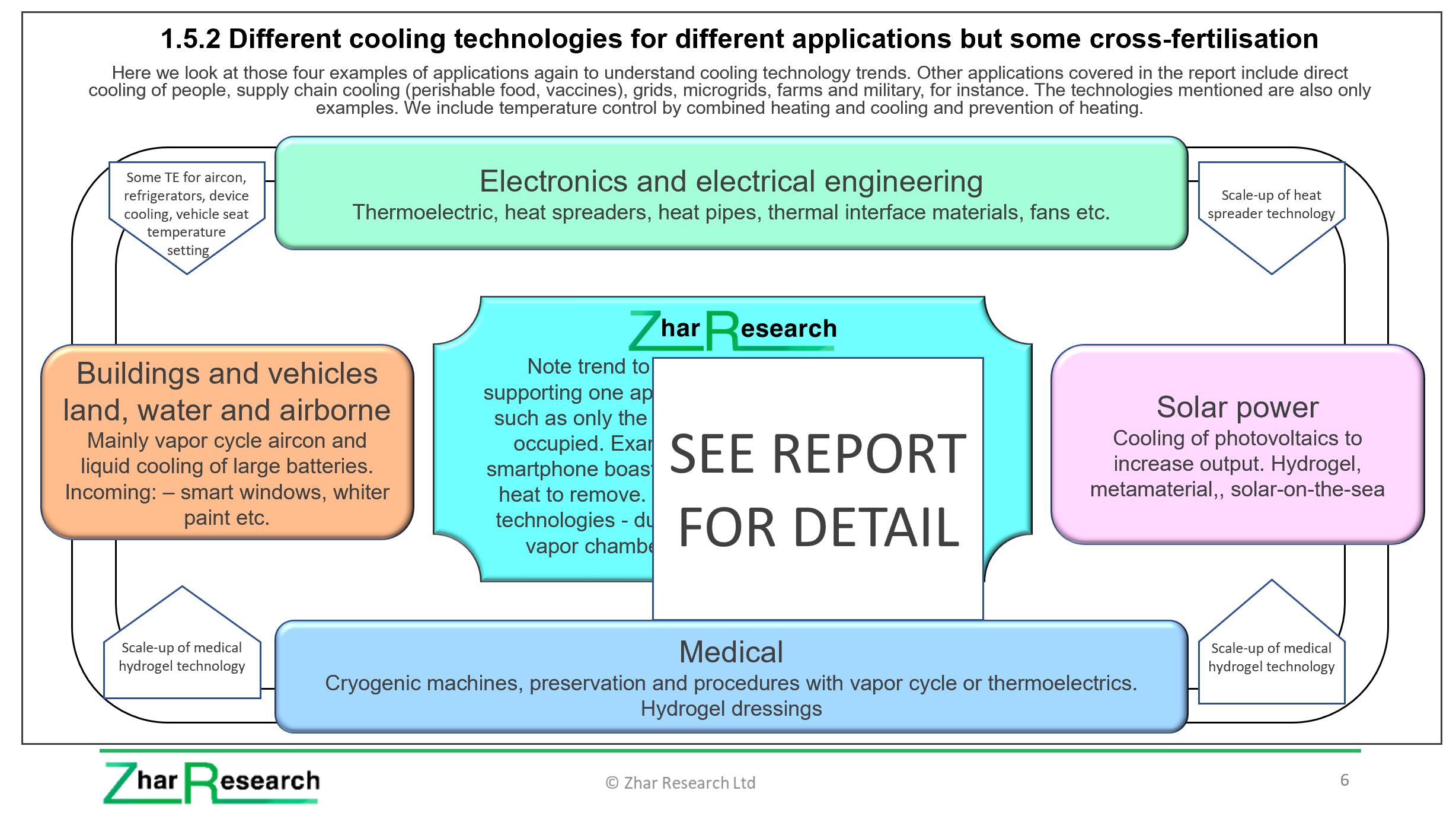

1.5.2 Different cooling technologies for different applications but some cross-fertilisation

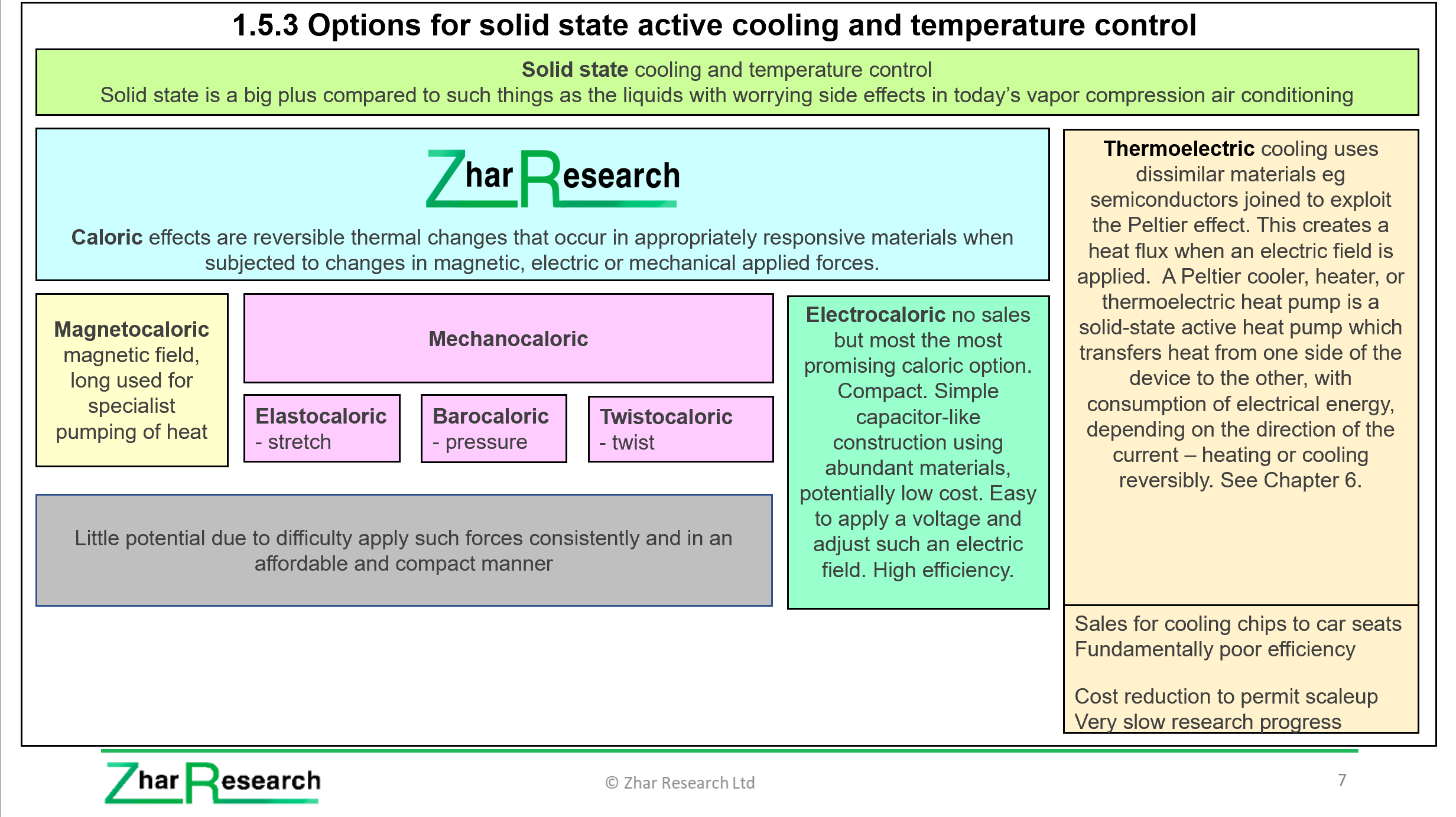

1.5.3 Options for solid state active cooling and temperature control

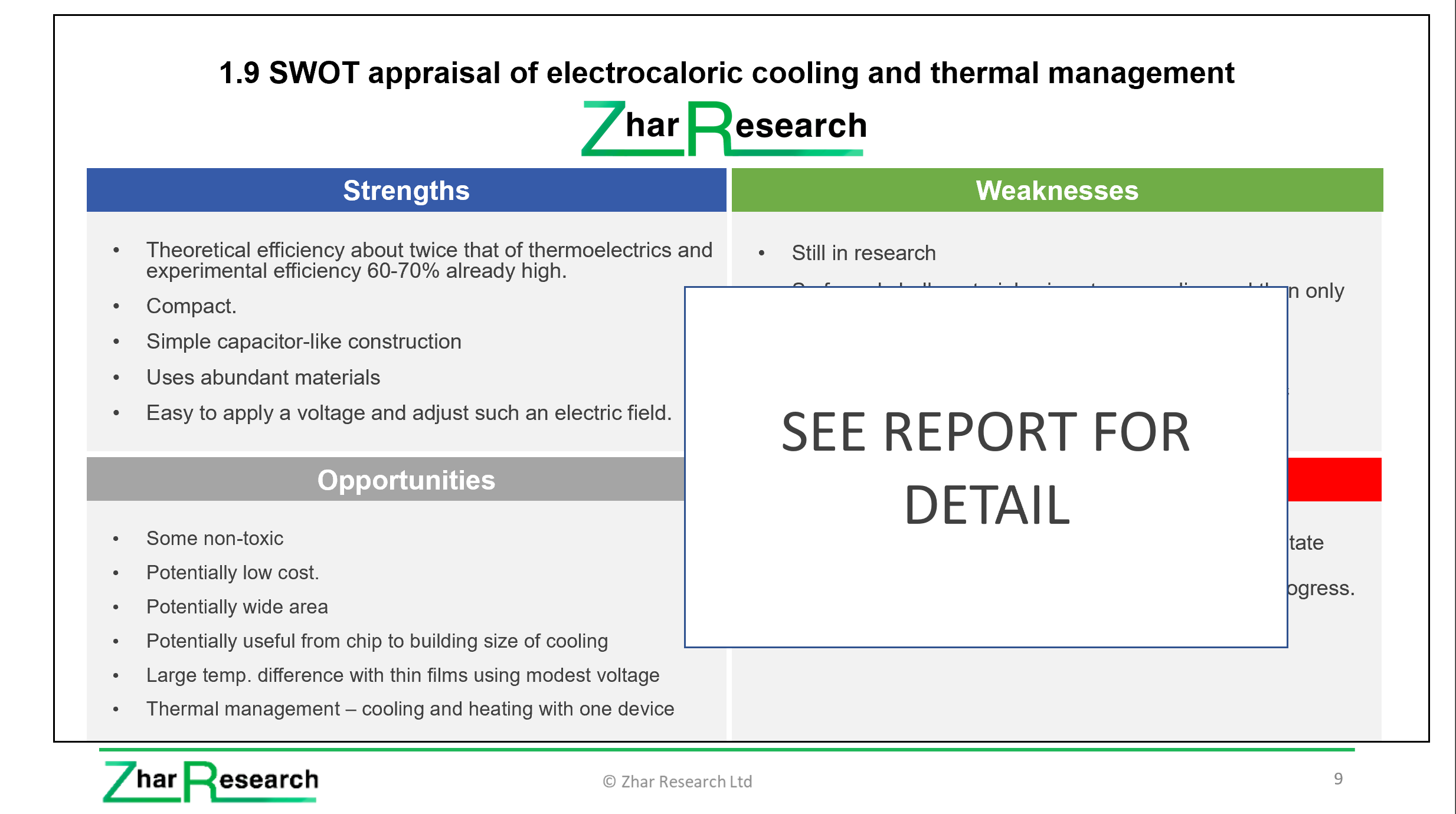

1.5.4 Caloric cooling and thermal management with electrocaloric SWOT appraisal

1.5.5 Thermoelectrics reinvented with SWOT appraisal

1.6 Seven primary conclusions: emerging demand for active cooling and thermal management

1.7 14 primary conclusions: emerging technologies for active cooling and thermal management

1B Market forecasts, roadmaps

1.8 Market forecasts 2023-2043

1.8.1 Air conditioner value market $ billion 2023-2043

1.8.2 Refrigerator and freezer value market $ billion 2023-2043

1.8.3 Thermoelectric value market $ billion: materials, modules, host equipment 2023-2043

1.8.4 Caloric cooling market: materials, modules, host equipment 2023-2043

1.8.5 Cryogenic equipment market 2023-2043

1.8.6 Smartphone thermal materials market area million square meters 2023-2043

1.8.7 Percentage division of $2 billion market in 2036 for low loss and thermal materials for 6G infrastructure and client devices

1.8.8 6G and 6G/5G smartphone combined sales units billion yearly 2023-2043

1.8.9 Smartphones billion yearly with 6G impact 2023-2043

1.8.10 6G base stations thermal interface materials million square meters 2023-2043

1.8.11 Market for 6G base stations millions 2023-2043

1.8.12 Internet of Things nodes number billion 2023-2043

1.8.13 Stationary battery market 2023-2043

1.8.14 LDES market by 11 technology categories $ billion 2023-2043, winners, losers

1.8.15 Regional split of LDES market value 2023 and 2043

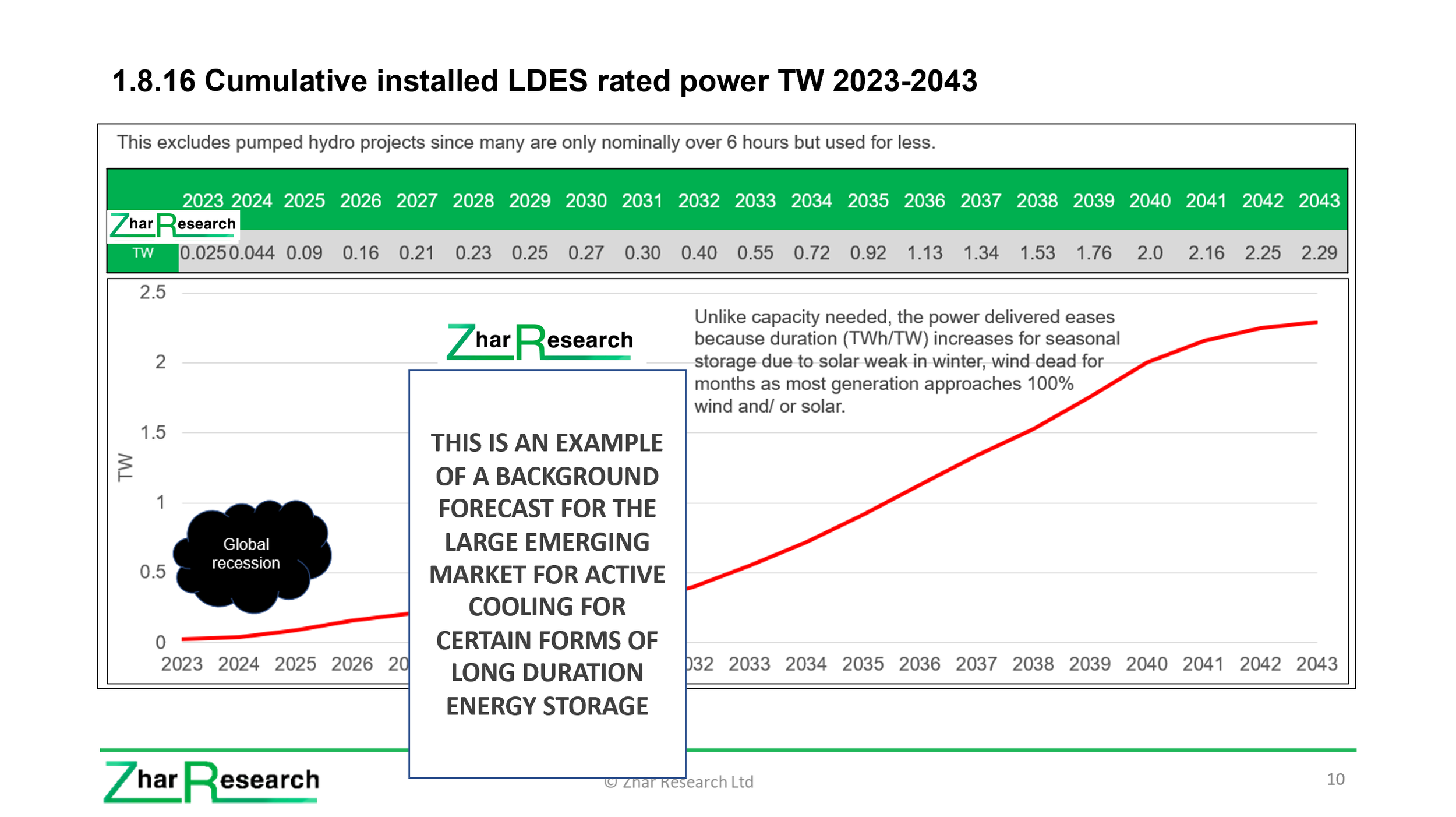

1.8.16 Cumulative installed LDES rated power TW 2023-2043

1.8.17 Thermal material host hardware market $ billion 2023

1.9 Technology maturity

1.9.1 Active cooling and thermal management technology maturity by type 2023

1.9.2 Active cooling and thermal management technology maturity by type 2033

1.9.3 Active cooling and thermal management technology maturity by type 2043

1.10 Active cooling and thermal management roadmaps

1.10.1 Active cooling and thermal management market and technology roadmap 2023-2033

1.10.2 Active cooling and thermal management market and technology roadmap 2034-2043

-

2.1 Overview

2.2 New and strengthening needs for cooling

2.2.1 Future buildings

2.2.2 Vehicles and large batteries for vehicles, microgrids and grids

2.2.3 Thermal management for the new Long Duration Energy Storage

2.2.4 Large processors, power electronics for grids, microgrids, vehicles, telecoms.

2.2.5 Planned 6G Communications, other electronics, ICT including data centers

2.2.6 Windows and greenhouses

2.2.7 Solar panels and surfaces

2.2.8 Cooling apparel and wearables

2.2.9 Food supply chains and medical

2.2.10 Large batteries for electric vehicles land, water, air

2.2.11 Sensors measuring or using thermal phenomena

-

3.1 Overview

3.2 Active vs passive cooling

3.3 Finding air conditioner alternatives that are lower power, greener, more affordable

3.4 Helium thermoacoustic freezer: lessons of failure

3.5 Powered windows and facades that cool or prevent heat on demand

3.5.1 Radiative electrochromism

3.5.2 Switchable optofluidics

3.5.3 Multimode optofluidics

3.5.4 Switchable phase change reflection

3.5.5 Electricity from electrochromics

3.5.6 Acoustic Friendly Ventilation Window AFVW

3.6 Hydrogen in transit and its refuelling station cooling: NanoSun Coolth

3.7 Fan cooling reinvented – phone to subway

3.7.1 Super efficient blown cooling in electronics: Frore Airjet®, Nubia

3.7.2 Smartphone multi-mode cooling: 3D ice-level dual pump VC liquid cooling Infinix, Nubia

3.7.3 New subway cooling technology

3.8 Expected extra cooling demand in 6G Communications infrastructure and client devices

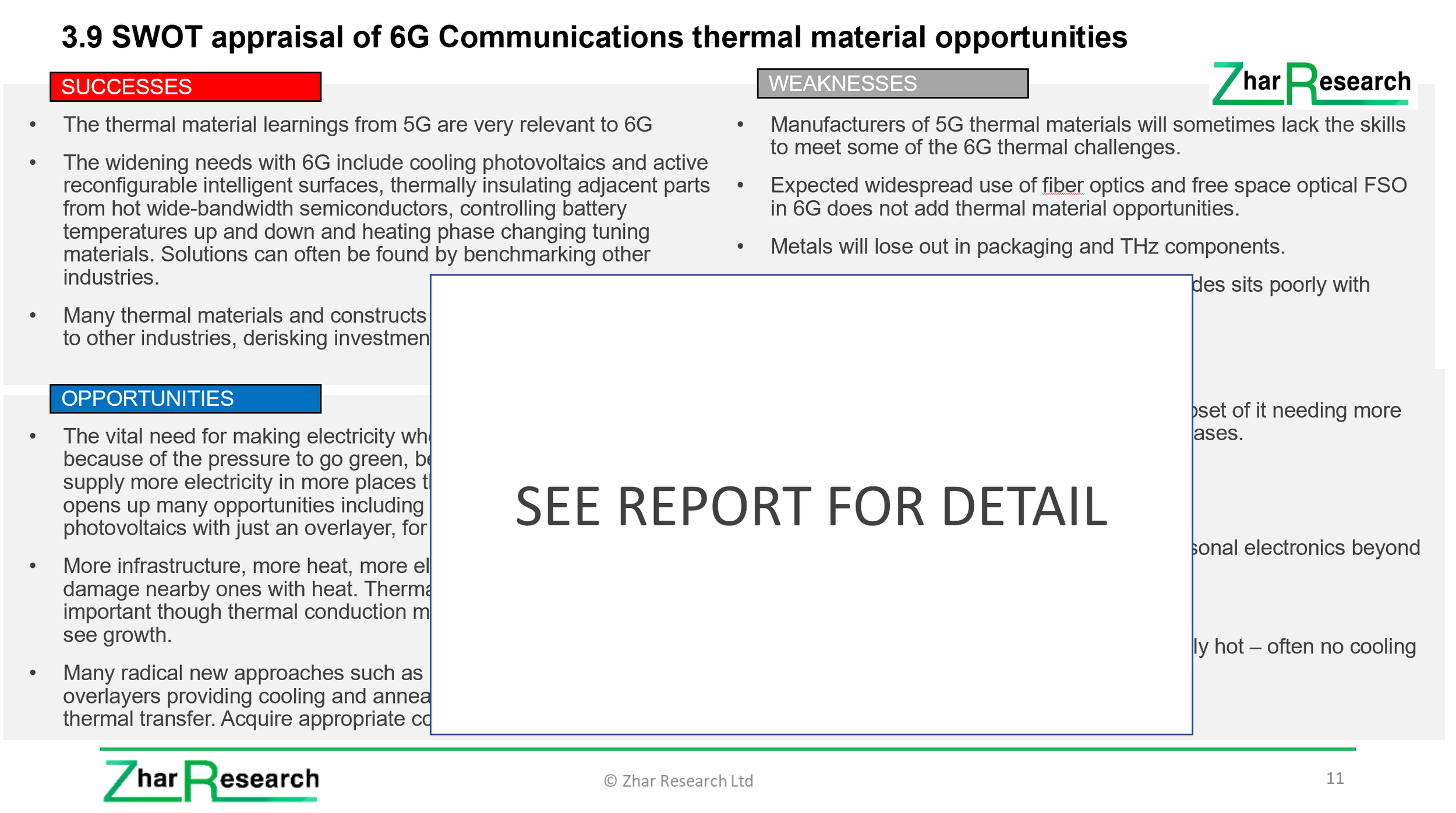

3.9 SWOT appraisal of 6G Communications thermal material opportunities

-

4.1 Overview

4.1.1 Emerging markets for cooling solutions including large batteries for vehicles, grids and batteryless LDES for grids

4.2 New batteries and their thermal management opportunities emerging

4.2.1 Infogram: specific energy vs specific power for kWh-MWh battery storage technologies

4.2.2 Battery thermal safety issues and new solutions

4.2.3 Traditional cooling approaches for large battery in a electric car, truck, boat, aircraft

4.2.4 Examples of proposed cooling of large batteries in future

4.3 LDES – a large emerging market for thermal solutions

4.3.1 Prioritising LDES cooling and thermal management opportunities

4.3.2 Thermal management for the new Long Duration Energy Storage

4.3.3 Identifying the best opportunities for cooling and thermal management solutions

4.4 Compressed air energy storage CAES thermal opportunities

4.5 Liquefied air energy storage LAES thermal opportunities

4.6 Carbon dioxide energy storage thermal opportunities

-

5.1 Options for solid state cooling and temperature control

5.2 Basic principles

5.3 Electrocaloric cooling shoots ahead of other caloric options – work ahead

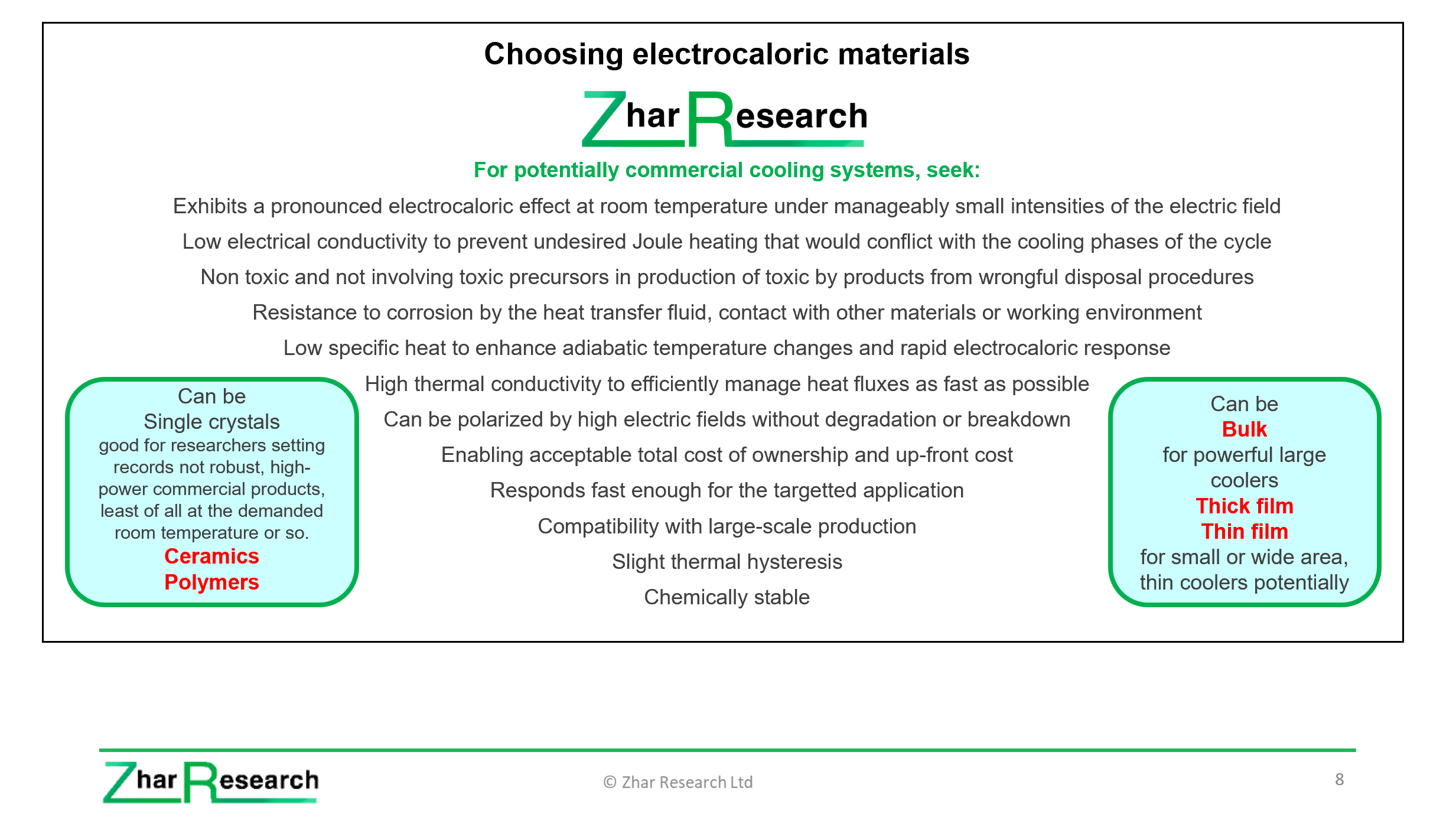

5.3.1 Choosing electrocaloric materials

5.3.2 Material taxonomies and measurement issues

5.3.3 Order of phase transition and speed of response

5.3.4 Polymers and polymer nancomposites compared

5.3.5 Ceramics compared

5.3.6 Direct electrocaloric cooling by negative effect

5.3.7 Likely EC applications and system designs based on current knowledge

5.3.8 Recent research on electrocaloric material formulations

5.3.9 Recent research on electrocaloric systems

5.3.10 SWOT appraisal of electrocaloric cooling and thermal management

5.4 Magnetocaloric and mechanocaloric (elastocaloric, barocaloric, twistocaloric) cooling

5.4.1 Research on barocaloric materials and systems

5.4.2 Research on elastocaloric and other mechanocaloric materials and systems

5.5 Ionocaloric and electrochemical cooling

5.5.1 Ionocaloric cooling

5.5.2 Continuous electrochemical refrigeration Brayton cycle

-

6.1 Basics

6.1.1 Operation

6.1.2 Thermoelectric effects and relevance to cooling

6.2 SWOT appraisal of thermoelectric cooling and temperature control

6.3 Radical new advances

6.3.1 Thermal locking by ferrons

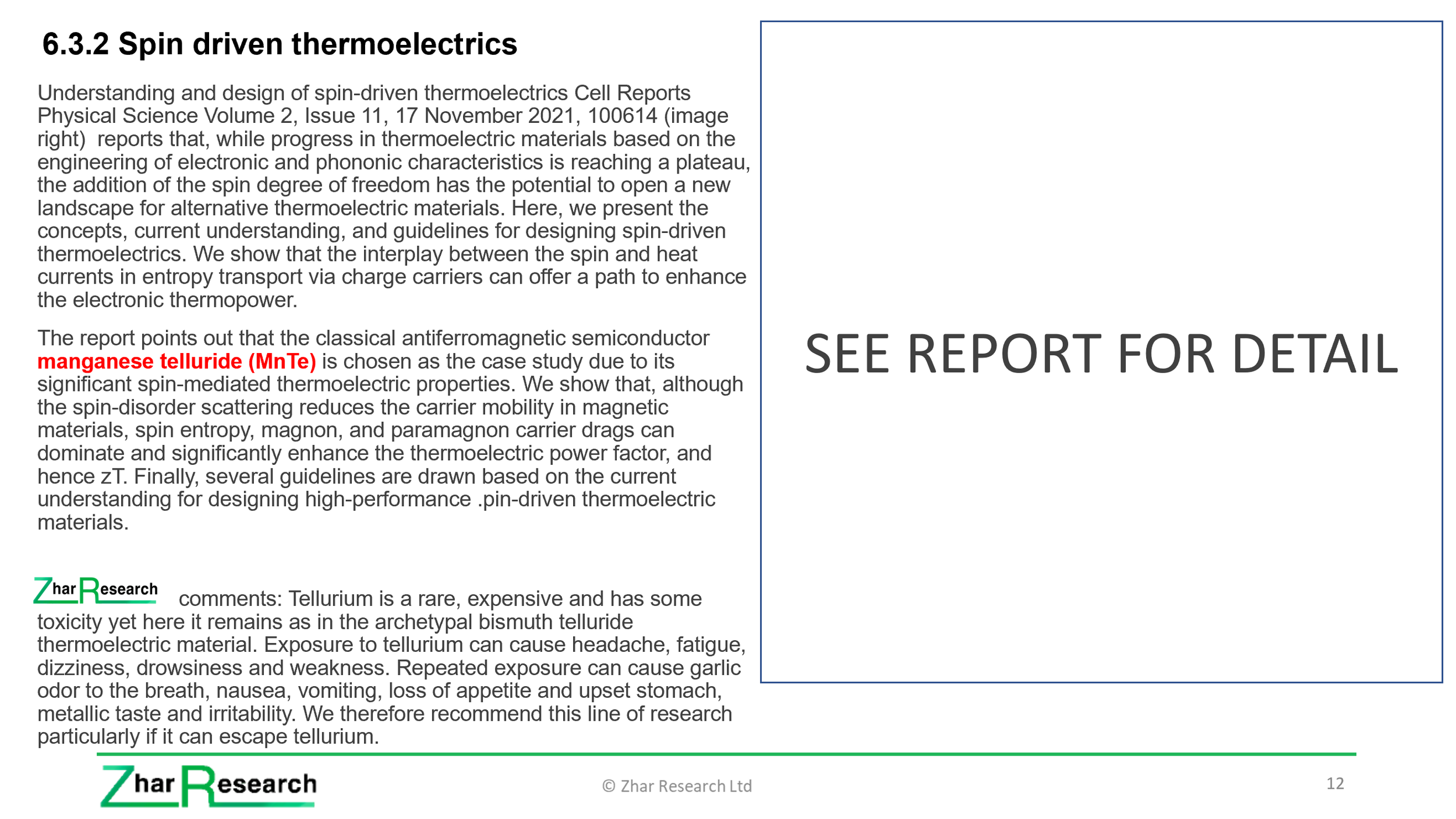

6.3.2 Spin driven thermoelectrics

6.3.3 New manufacturing for new morphology

6.3.4 Radiative cooling powering active cooling

6.3.5 Non-toxic and less toxic thermoelectrics, some lower cost

6.3.6 Better performing thermoelectric cooling materials ahead

6.4 Emerging applications of thermoelectric cooling

6.4.1 Overview

6.4.2 Water coolers, medical devices, humid environments

6.4.3 Vehicle seats, aircraft, small refrigerators, batteries

6.4.4 Scientific instruments, next generation chips, lasers

6.5 82 Manufactures of Peltier thermoelectric modules and products

Global warming drives the need for much more cooling technology but so does forthcoming equipment such as kW level microprocessors, 6G Communications, electric vehicles and planned long duration energy storage using compressed or liquid air. The new 270-page Zhar Research report, “Active cooling: large new materials, systems markets 2023-2043” has the latest information and analysis of the technologies and major markets arriving, creating billion dollar enterprises.

Traditional cooling and thermal management is either inadequate or unsustainable for most of these needs. Fortunately there is a rich research pipeline of new active (powered) cooling and temperature-holding technologies from twistocaloric, ionocaloric, switchable optofluidic and electrochemical to thermoelectrics reinvented and even arriving technologies for powered cooling smart windows. There is much more. In the meantime, air cooling is being reinvented and direct liquid cooling is rapidly gaining adoption in many sizes and with new materials. How, where, why? Why the electrocaloric enthusiasm?

This report is commercially-oriented critically assessing and predicting tracking all these topics for 2023-2043 with up-to-date inputs, much from 2023. It is primarily intended to provide all in the value chain of active (powered) cooling materials and systems with their opportunities from 2023-2043.

Being analysis not evangelism, it reveals emerging competition and markets going down as well as ones rising. It reveals sectors where less cooling will be needed in future and where passive cooling replaces active cooling. However, mostly it is able to reveal many sectors and technologies where billion dollar new businesses will be created that provide active cooling materials and systems. By a detailed examination of the research pipeline, it recommends a large number of the best research reports for further reading. See the most potentially impactful value-added cooling materials and the most important new cooling principles emerging. There is a roadmap of new market arrivals, technology advances and commercialisation 2023-2043 and their likely impact plus many market forecasts.

In short, this report will be very useful for all from value added materials suppliers to product and system integrators and users. It reveals gaps in the market and emerging competition and the applicational scope is wide, though it is impossible to cover everything in this rapidly evolving field. There are 98 new infograms, tables and images, 28 yearly forecasts 2023-2043, seven other and six SWOT appraisals.

The Executive Summary and Conclusions is sufficient for those needing the whole picture rapidly. Its 60 pages provide easy yet deeply informative basics, technology and market comparisons, forecasts, roadmaps.

Chapter 2 at 48 pages addresses cooling problems that are emerging opportunities 2023-2043, explaining different types of need for cooling people or things, emerging severe needs and potentially large markets for solutions to these. See types of cooling and their limitations: passive, active and their subsets with examples of limitations of certain cooling principles. The subject is brought to life with thermal consideration of NEOM smart city, future buildings, windows, greenhouses, refrigerators, freezers, electric vehicles, large batteries for vehicles, microgrids, grids and cooling new massive grid Long Duration Energy Storage LDES processes. We also introduce the new challenges (opportunities) with large processors, power electronics for grids, microgrids, vehicles and telecommunications such as planned 6G Communications, other electronics, ICT including data centers, solar panels, apparel, wearables, food supply chains and medical.

The 35 pages of Chapter 3 “Active cooling reinvented: buildings, windows, fans” includes finding air conditioner alternatives that are lower power, greener, more affordable with a lesson of failure profiled. The technology and potential of powered windows and facades that cool or prevent heat on demand. Here are critiques of radiative electrochromism, switchable optofluidics, multimode optofluidics, switchable phase change reflection, electricity from electrochromics and the “Acoustic Friendly Ventilation Window AFVW” – a smart fan approach leading to more on fan cooling reinvented – phone to subway – and including nano blowing and tiny new smartphone fans. It ends with expected extra cooling demand in 6G Communications infrastructure and client devices and a SWOT appraisal of this.

Chapter 4 is “Active cooling reinvented: Large batteries for land, water and airborne vehicles, microgrids, grids and the emerging Long Duration Energy Storage LDES”. In 40 detailed pages it looks closely at these needs with today’s solutions and a glimpse of where we are headed with three SWOT appraisals and new infograms.

After those chapters looking at new markets with examples of appropriate technologies, the last two chapters deep dive specifically into new technologies including materials opportunities arising. Chapter 5. takes 46 pages to cover “New arrivals: caloric and electrochemical cooling and temperature control”. Navigate the thicket of magnetocaloric, elastocaloric, twistocaloric, barocaloric, ionocaloric and electrochemical cooling and see why the research pipeline is richest for electrocaloric and why Zhar Research considers this to be appropriate, giving views of what it will achieve when commercialised.

The report ends with the 26 page chapter, “Thermoelectric cooling reinvented” – something of a surprise, because this old technology has radically new options arriving that may make it viable for large area, high power, better cooling of small things – its current heartland. Learn thermal switching with ferrons, spin-driven thermoelectrics, non-toxic and stronger-performance thermoelectric materials and more with many of the companies involved being listed. Indeed, this unique report mentions over 120 companies and the selected best research papers cited run to over 50.